Consumer sentiment bounces back in September

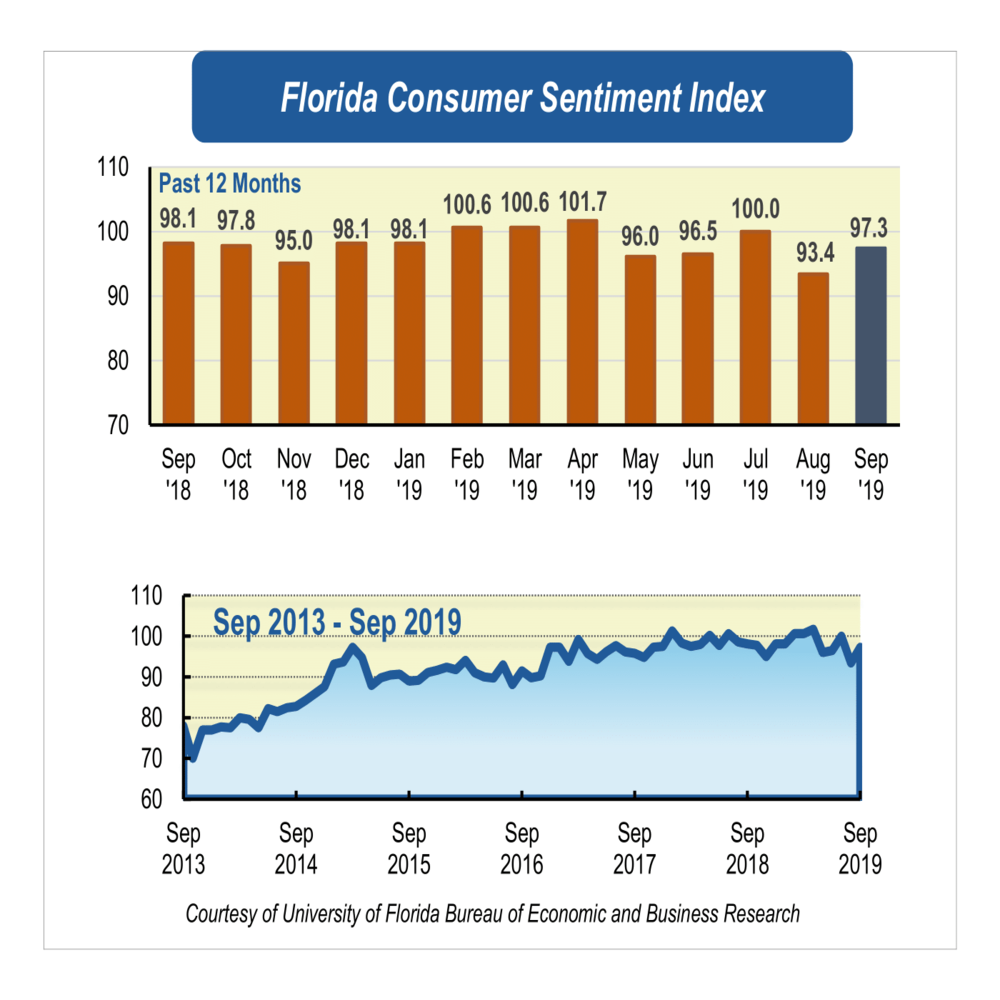

After plummeting 6.6 points last month, consumer sentiment among Floridians ticked up 3.9 points in September to 97.3 from August’s revised figure of 93.4. Similarly, the University of Michigan’s nationwide consumer sentiment index increased 3.4 points in September.

Among the five components that make up the index, four increased and one decreased.

Floridians’ opinions about current economic conditions were mixed. Perceptions of personal financial situations now compared with a year ago decreased six-tenths of a point from 87.3 to 86.7. In contrast, opinions as to whether now is a good time to buy a major household item like an appliance increased 5.4 points from 99.6 to 105.

“Although these two components of the index moved in opposite directions, overall they showed that opinions regarding current economic conditions improved among Floridians in September. However, these views are divided by age. While those younger than age 60 expressed favorable views, those age 60 and older expressed less favorable opinions in both components,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Outlooks toward future economic conditions improved in September. Expectations of personal finances a year from now increased 2.5 points from 102 to 104.5. Floridians indicated they have high hopes for U.S. economic conditions over the next year with that component increasing 6.9 points from 90.4 to 97.3, the greatest increase of any reading this month. Finally, expectations of U.S. economic conditions over the next five years increased 4.9 points from 88 to 92.9.

“Overall, Floridians are more optimistic in September compared with August. The increase in this month’s confidence stems from consumers’ expectations regarding the national economic conditions over the next year. Notably, this perception is shared by all Floridians without exception, and it is particularly strong among women, those age 60 and older, and those with income levels above $50,000,” Sandoval said.

Economic indicators in Florida also remained largely positive. Florida’s labor market continued strengthening with monthly job gains. In August, 221,200 jobs were added statewide compared with a year ago, an increase of 2.5%. Among all industries, education and health services gained the most jobs, followed by professional and business services, and leisure and hospitality. The only industry losing jobs over the year was information. The unemployment rate in Florida remained unchanged at 3.3% in August.

Furthermore, according to the U.S. Bureau of Economic Analysis, Florida ranked 12th of all states in the country in personal income growth with a growth rate of 6% in state personal income in the second quarter of 2019. The main contributor to this change came from net earnings, which includes wages, salaries and supplements but excludes contributions from government social insurance.

“Despite the ups and downs experienced by the index over the last several months, consumer sentiment has remained high, and thus we anticipate it to continue at the same levels in the following months,” Sandoval said.

Conducted September 1-26, the UF study reflects the responses of 386 individuals who were reached on cellphones, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/