Florida consumers more optimistic in December, but concerns linger heading into 2026

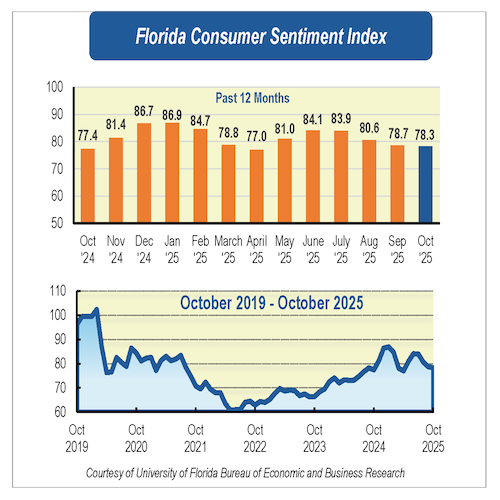

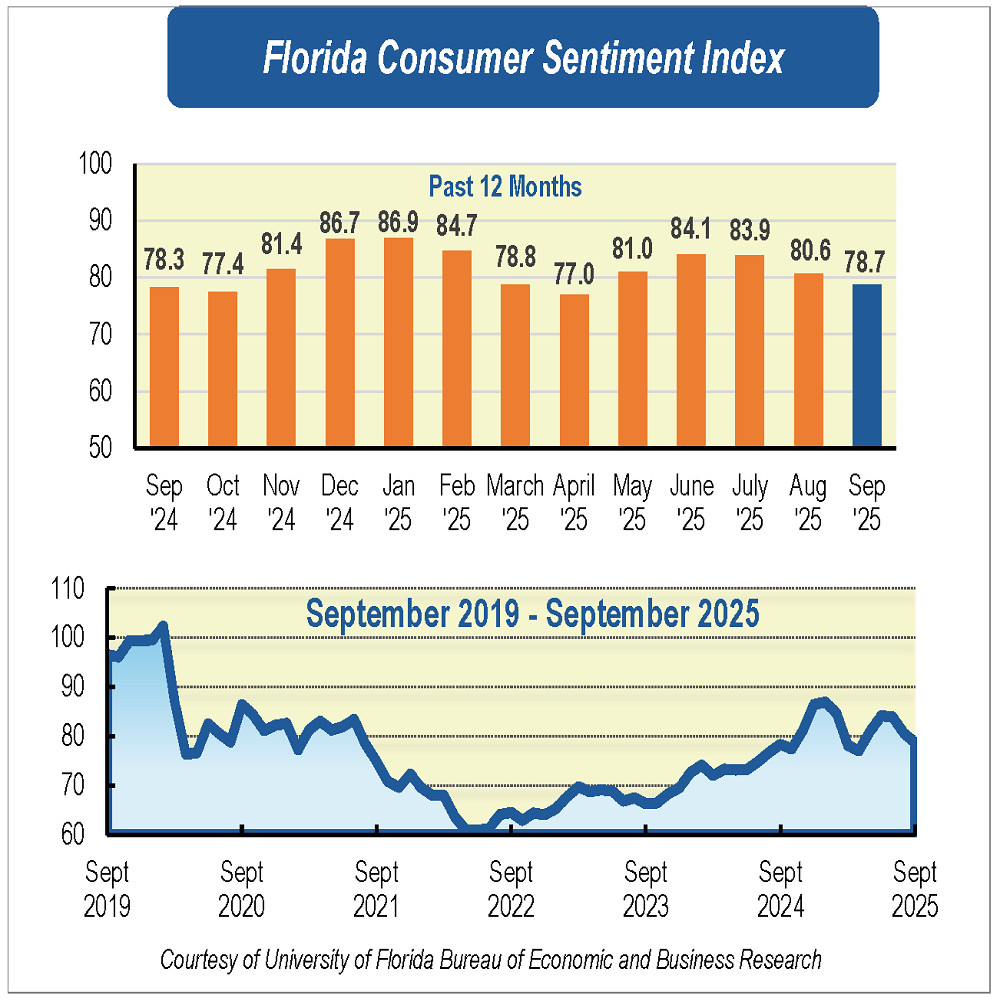

- Florida consumer sentiment rose in December, posting a modest month-over-month gain, even as overall confidence remained well below levels seen at the start of 2025.

- Economic uncertainty persisted throughout the year, driven by policy changes, labor market softening and inflation pressures, offset in part by Federal Reserve interest rate cuts.

- Looking ahead to 2026, optimism improved for future conditions, but challenges such as inflation and labor market trends continue to shape Floridians’ economic outlook.

Consumer sentiment among Floridians increased in December, rising 2.4 points to 74.9 from 72.5 in November. National consumer sentiment rose 1.9 points over the month.

“As the year ends, Florida’s consumer sentiment closes with an overall decline, with December’s reading nearly 12 points below January’s level. This downward shift was observed across sociodemographic groups. It is worth noting that the gains in sentiment following the November 2024 presidential election were erased, leaving consumer sentiment near the average levels observed prior to the election. These trends are not surprising given the significant policy changes introduced by the new administration, which added uncertainty for economic agents, particularly with respect to trade policy. Other relevant developments included reductions in the federal workforce, the longest federal government shutdown of the year, which affected federal data collection; a softening labor market characterized by limited hiring and layoffs, and persistent inflationary pressures. At the same time, the Federal Reserve cut interest rates three times, lowering borrowing costs across economic agents. Together, these factors have had noticeable effects on Floridians’ consumer sentiment and their economic outlook,” said Hector H. Sandoval, director of the Economic Analysis Program at the University of Florida’s Bureau of Economic and Business Research.

Among the five components that make up the index, four increased while one declined.

Floridians’ opinions about current economic conditions were mixed in December. Views of personal financial situations compared with a year ago increased 3.9 points from 64.8 to 68.7. These views varied across sociodemographic groups, with women, people ages 60 and older, and people with an annual income under $50,000 expressing less favorable opinions. In contrast, opinions about whether this is a good time to buy a big-ticket household item, such as a refrigerator or furniture, declined slightly 0.4, from 62.4 to 62.0. These views were also split by demographics, with men and people with an annual income over $50,000 expressing more favorable opinions.

Floridians’ expectations about future economic conditions improved in December, with all three forward-looking components increasing. Expectations of personal finances a year from now rose 3.2 points from 85.9 to 89.1. Expectations regarding U.S. economic conditions over the next year increased 1.1 points from 75.5 to 76.6. Meanwhile, expectations of U.S. economic conditions over the next five years rose 3.9 points from 74.0 to 77.9, representing one of the largest increases among the index components this month, alongside views of current personal finances. These positive expectations were shared by most Floridians, although women, people younger than 60, and people with an annual income under $50,000 expressed more pessimistic views regarding the national economic outlook over the next year.

“As the new year begins, while consumer sentiment declined across sociodemographic groups and across all five components of the index over the course of 2025, the economy enters 2026 with economic agents potentially becoming more accustomed to recent policy changes. As policies begin to settle, uncertainty may ease, which could lead to smaller swings in consumer sentiment over the year ahead,” said Sandoval.

“However, several challenges remain. Looking ahead, it will be important to continue monitoring inflation, which remains above the Fed’s 2 percent target, as well as labor market conditions, as both will influence the Fed’s future policy decisions. Tracking consumer sentiment will help assess how Floridians perceive their financial situation and the broader economy as we move into 2026,” Sandoval added.

Releases beginning in December 2025 are based on a telephone survey sample. Accordingly, all figures and comparisons for the overall index and its components in this release are derived exclusively from telephone survey data. Graphs have been updated to reflect telephone-only data starting in December 2024.

Conducted Nov.1-Dec.19, the UF study reflects the responses of 251 individuals who were reached on cellphones representing a demographic cross section of Florida.

Data are weighted based on Florida county of residence, age group, and sex to ensure representativeness of the Florida population. The population figures used for weighting (targets) are obtained from the Population Program of the Bureau of Economic and Business Research (BEBR), which produces the official population estimates for the state of Florida. Phone data quality is maintained by monitoring and reviewing interviews and preventing duplicate records.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence as in that year. The lowest index possible is 2, and the highest is 150.

Details of this month’s survey can be found at bebr.ufl.edu/florida-consumer-sentiment/.