Economic concerns drive second-biggest fall in Florida consumer index

Consumer sentiment among Floridians dropped 3.1 points in August to 80.6, down from a revised figure of 83.7 in July. The decline was slightly smaller than the 3.5-point drop observed at the national level.

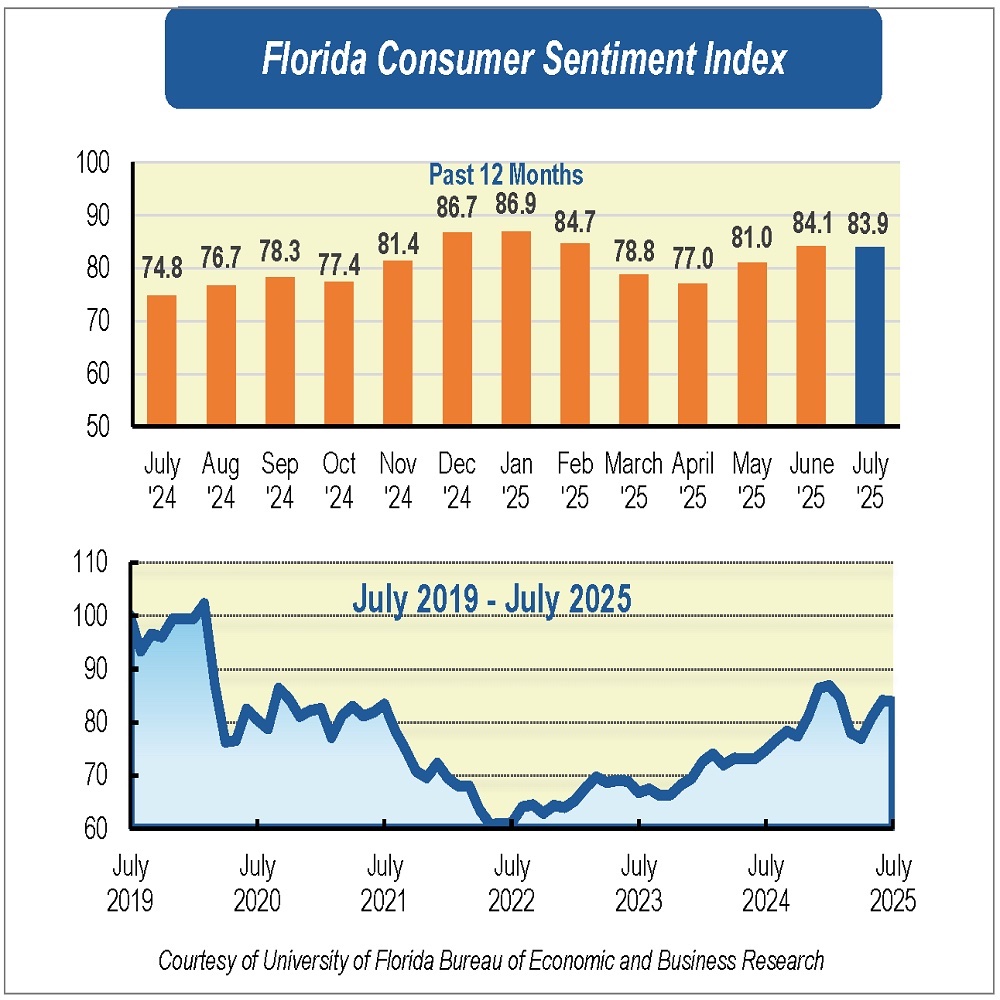

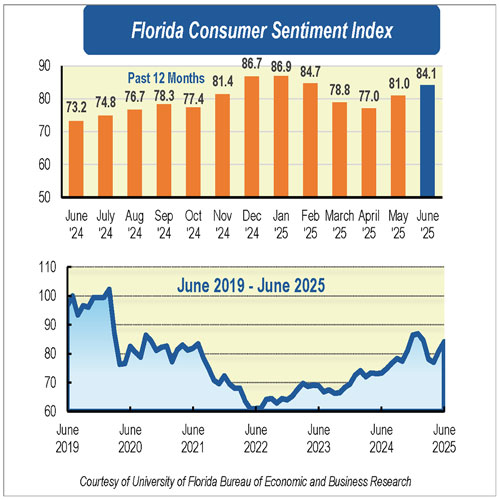

“This marks the second-largest monthly decline in sentiment this year, surpassed only by the 5.9-point drop recorded in March. Moreover, the July figure was revised slightly downward from 83.9 to 83.7, now resulting in a monthly decline in sentiment. August’s decline reflects growing pessimism about both current and future personal financial conditions, along with a pullback in spending intentions. Together, these trends suggest that Floridians may be bracing for tougher economic conditions and are likely to be more cautious with their discretionary spending,” said Hector H. Sandoval, director of the Economic Analysis Program at the University of Florida’s Bureau of Economic and Business Research.

Each of the five components that make up the index declined in August.

Floridians’ views on current economic conditions turned more negative. Opinions of personal financial situations now compared with a year ago posted the steepest drop this month, falling 4.6 points from 76.3 to 71.7. Similarly, opinions on whether now is a good time to buy a major household item, such as a car or appliance, declined 3.5 points from 78.5 to 75. These views were mixed across demographic groups, with men expressing more favorable opinions on the former component and people with an annual income under $50,000 on the latter.

Likewise, expectations about future economic conditions worsened. Expectations of personal financial situations a year from now fell 3.3 points from 91.3 to 88. These expectations were shared across sociodemographic groups, except for men, who reported more positive views. Outlooks of U.S. economic conditions over the next year dropped 1.4 points from 86 to 84.6, while expectations of U.S. economic conditions over the next five years declined 2.4 points from 86.1 to 83.7. These views varied across demographics, with men, people 60 and older, and people with an annual income under $50,000 holding more optimistic expectations.

In August, the economy showed signs of strain as inflation pressures intensified. Wholesale prices rose sharply, and consumer prices also increased, with both the Consumer Price Index and the Personal Consumption Expenditures index remaining slightly further from the Federal Reserve’s 2% target. Inflation expectations also edged higher. At the same time, national labor market conditions softened: Job growth slowed, and previous months were revised downward. However, the unemployment rate held steady, and claims for unemployment benefits remained broadly unchanged. In Florida, the unemployment rate was also unchanged, and nine of the state’s major industries reported year-over-year job gains in July.

At the Jackson Hole symposium, the Fed reaffirmed its 2% inflation target while acknowledging the ongoing trade-off between lowering inflation and supporting employment. Fed Chair Jerome Powell signaled the possibility of rate cuts in September, citing weaker job creation partially offset by slower labor force growth.

Meanwhile, the administration expanded its tariff campaign, introducing new levies such as a 50% tariff on goods from India and removing the de minimis exemption for low-value imports. A recent federal appeals court ruling also questioned the legality of many of these tariffs, adding more uncertainty to the trade policy outlook.

“Looking ahead, we expect consumer sentiment to remain weak in the coming months as long as current economic trends and policy uncertainty persist,” Sandoval said.

Conducted July 1 to Aug. 28, the UF study reflects the responses of 323 individuals who were reached on cellphones and 283 individuals reached through an online panel, for a total of 606 respondents, representing a demographic cross section of Florida.

Data are weighted based on Florida county of residence, age group and sex to ensure representativeness of the Florida population. The population figures used for weighting are obtained from the Population Program of the Bureau of Economic and Business Research, which produces the official population estimates for the state. Phone data quality is maintained by monitoring and reviewing interviews and preventing duplicate records. Online data quality is maintained by enabling and reviewing bot and fraud detection, eliminating “short time” completions, and preventing the survey from appearing in web search results.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is 2, and the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/.