Florida consumer sentiment shows mixed trends in July

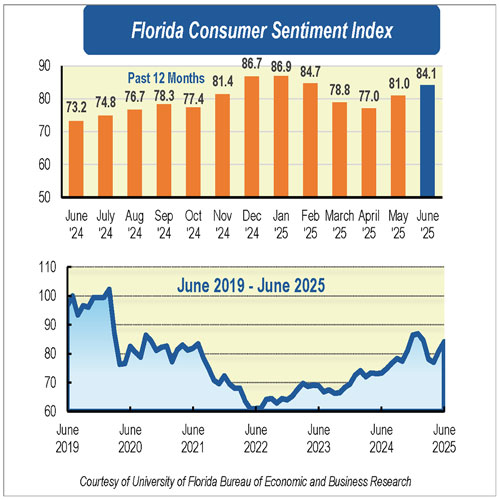

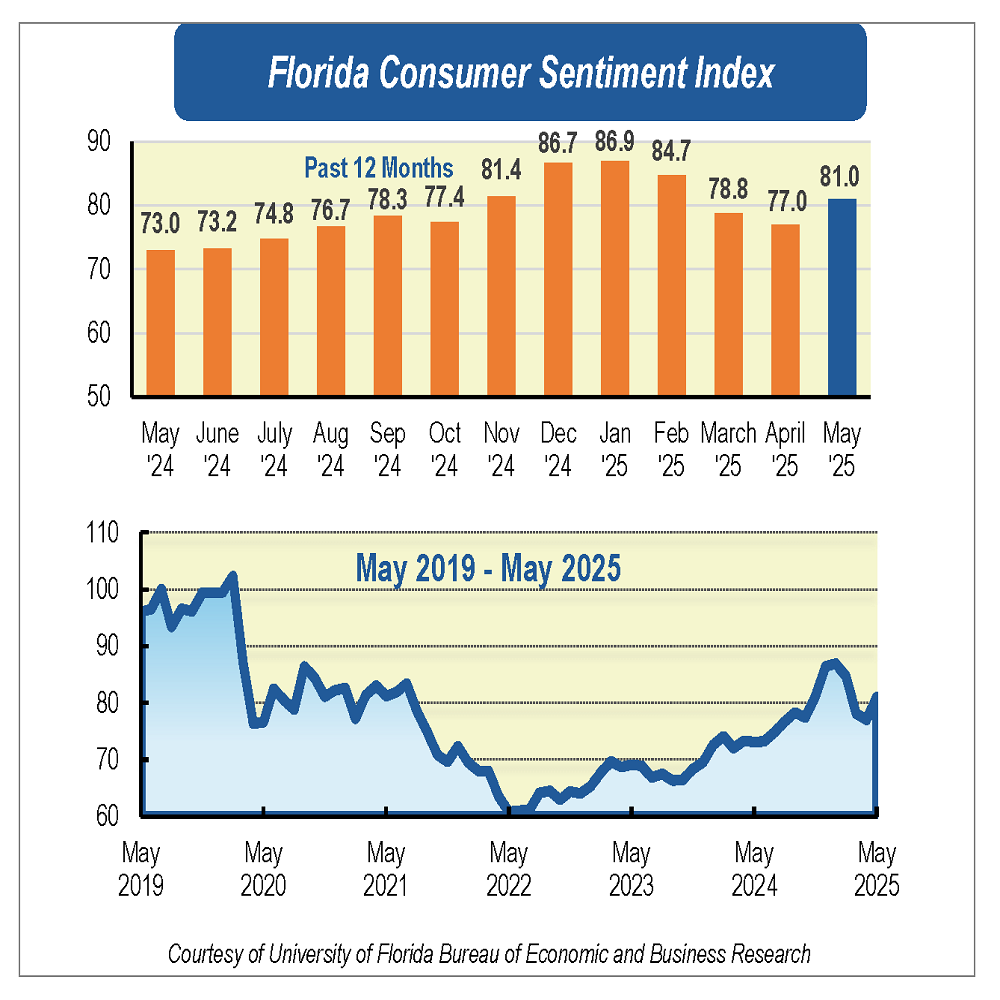

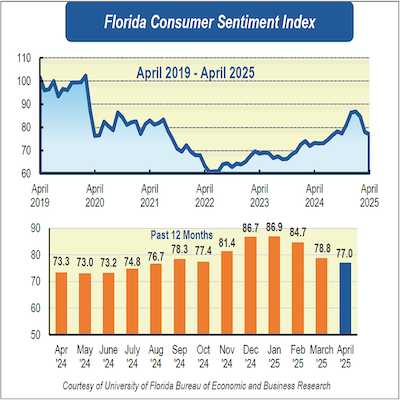

Consumer sentiment among Floridians was largely unchanged in July, edging up one-tenth of a point to 83.9 from a revised June figure of 83.8. National consumer sentiment also rose slightly, increasing by 1.1 points.

“Overall, sentiment remained essentially unchanged in July,” said Hector H. Sandoval, director of the Economic Analysis Program at the University of Florida’s Bureau of Economic and Business Research. “On the positive side, spending intentions continued to rise among Floridians. However, this month’s reading also points to some underlying concerns, including a slight weakening in views about personal finances and a drop in long-term expectations for the national economy.”

Sandoval noted that inflation, which had been nearing the Federal Reserve’s target, accelerated in June to 2.7%, with core inflation at 2.9%. That uptick may reinforce the Fed’s cautious stance. While retail sales remained solid despite trade policy uncertainty, higher inflation and elevated mortgage rates could be contributing to a more cautious consumer outlook.

Among the five components that make up the index, two increased while three declined.

Floridians’ views on current economic conditions were mixed. Opinions about personal finances now compared with a year ago fell four-tenths of a point, from 77.1 to 76.7. These views varied across demographic groups, with men, those age 60 and older, and individuals with annual incomes above $50,000 reporting more favorable assessments.

In contrast, views on whether now is a good time to buy a major household item, such as a refrigerator, rose 2.2 points to 79.5 — the highest level in nearly five years. These responses were also split, with less favorable views among those age 60 and older and those with incomes under $50,000.

“Spending intentions began rising sharply after the presidential election and continued into the early months of this year,” Sandoval said. “A notable dip in March signaled growing caution, likely driven by trade policy uncertainty. However, since April, spending intentions have steadily rebounded and are now back to levels seen at the start of the year. This recovery is an encouraging sign, as strong consumer spending remains a key driver of economic growth.”

Expectations about future economic conditions also showed mixed trends. Expectations for personal finances a year from now dropped eight-tenths of a point, from 92.6 to 91.8. Expectations for U.S. economic conditions over the next year rose 2.4 points to 86. However, long-term expectations for the national economy posted the largest decline, falling 3.3 points to 85.4. These shifts were broadly seen across demographic groups, with the exception of low-income respondents, who reported improved expectations for their personal finances.

“Looking ahead, trade policy appears to be stabilizing, with agreements now in place with several major partners, including the European Union,” Sandoval said. “This could support a further rebound in spending intentions and sentiment. However, inflation remains a key risk. Even a temporary surge could shake consumer confidence. It also remains to be seen how the newly adjusted tariff levels will affect the broader economy.”

The July findings are based on a UF study conducted June 1 to July 24, using a sample of 452 individuals — 204 reached by cellphone and 248 through an online panel — representing a cross-section of Florida’s population. Data are weighted by county, age group and sex to ensure statewide representation.

The consumer sentiment index used by UF researchers is benchmarked to 1966, with a value of 100 representing the same confidence level as that year. The lowest possible index value is 2; the highest is 150.

Details of the survey are available at bebr.ufl.edu/florida-consumer-sentiment.