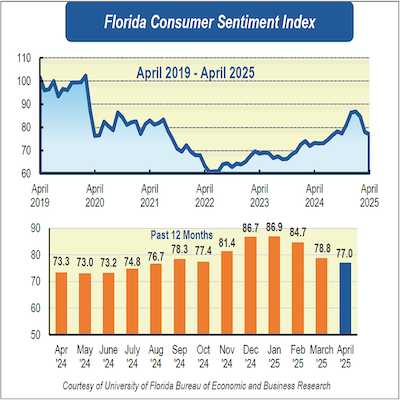

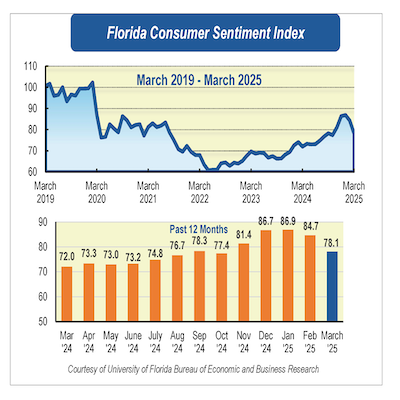

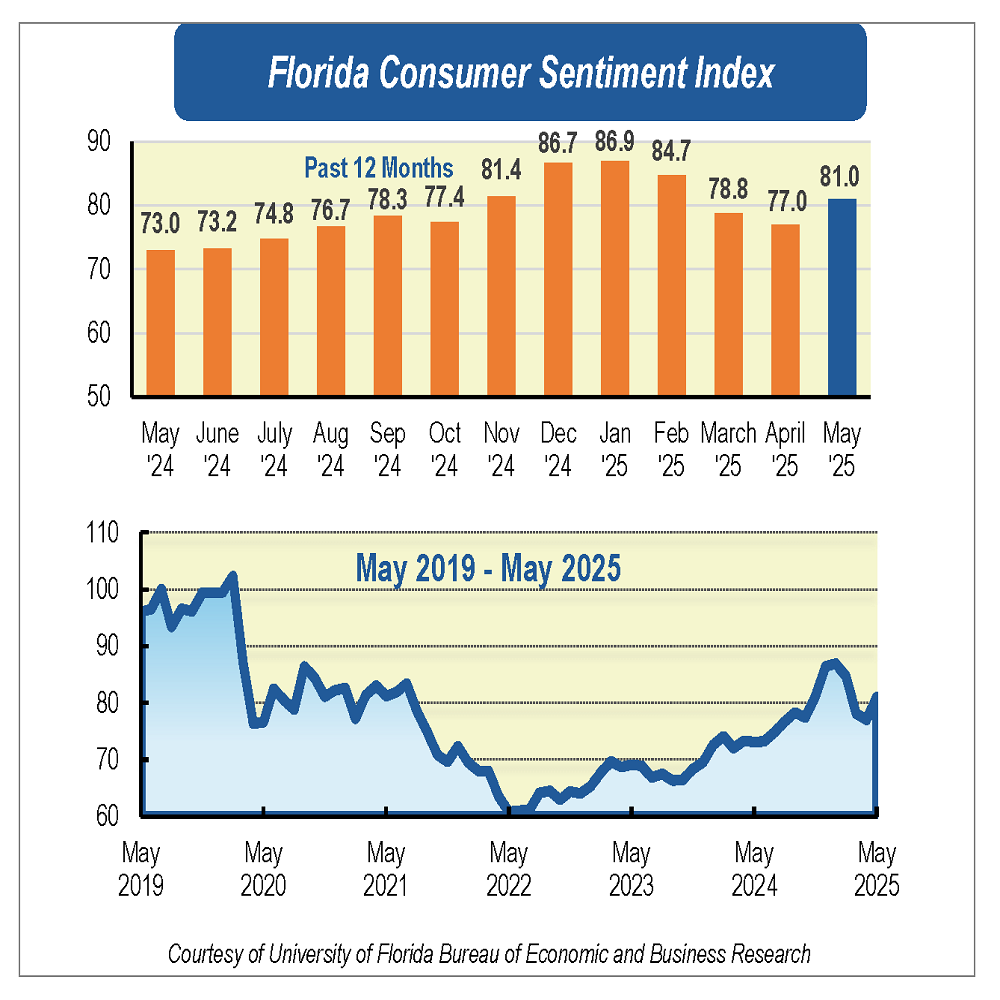

Florida consumer sentiment bounces back in May

After three consecutive months of declines, consumer sentiment among Floridians rose in May, increasing 3.7 points to 81 from a revised figure of 77.3 in April. In contrast, national sentiment remained unchanged.

“Consumer confidence had declined sharply in recent months, largely driven by falling spending intentions and growing pessimism about the national economy. In May, however, the rebound in sentiment was supported by a marked improvement in both Floridians’ willingness to make big-ticket purchases and their long-term outlook on the U.S. economy. This shift is likely tied to the easing of trade tensions between the U.S. and China earlier in the month, which included a reduction in tariffs on Chinese imports. These changes have likely eased some of the pessimism fueled by earlier tariff hikes,” said Hector Sandoval, director of the Economic Analysis Program at the University of Florida’s Bureau of Economic and Business Research.

All five components of the index improved in May.

Floridians’ views on current economic conditions strengthened. Opinions of personal financial situations now compared with a year ago rose 3.5 points, from 68.5 to 72. Similarly, opinions on whether now is a good time to buy a big-ticket item, such as furniture or appliances, increased 5.4 points, from 68.5 to 73.9 — the largest gain among all components this month. These more positive views were broadly shared across sociodemographic groups, except for people age 60 and older, who reported more negative views on their financial situation.

Expectations about future economic conditions also improved. Expectations of personal finances a year from now rose 1.5 points, from 89.1 to 90.6. However, views were divided across groups, with women, people 60 and older, and those with an annual income under $50,000 expressing more pessimistic expectations. Expectations about U.S. economic conditions over the next year rose 2.4 points, from 78.4 to 80.8. Similarly, views on U.S. economic conditions over the next five years surged 5.3 points, from 82.2 to 87.5. These more optimistic outlooks were shared across all demographic groups.

Economic activity in Florida remains generally positive. The labor market continues to expand nationally and in the state, with steady job gains. Additionally, the latest inflation data show signs of improvement, with annual inflation measures moving closer to the Federal Reserve’s 2% target.

“However, trade tensions and uncertainty around trade policy persist. While there has been some easing, the outlook remains unclear. The possibility of new tariff hikes still looms, and recent legal disputes have added further uncertainty,” Sandoval said.

“Looking ahead, this continued uncertainty is likely to weigh on consumer confidence in the months to come,” he added.

Conducted from April 1 to May 29, the UF study reflects the responses of 600 individuals — 304 reached via cellphone and 296 through an online panel — representing a demographic cross section of Florida.

Data are weighted based on Florida county of residence, age group and sex to ensure representativeness of the state population. Population figures used for weighting are obtained from the Population Program of the Bureau of Economic and Business Research, which produces the official population estimates for Florida. Phone data quality is maintained by monitoring interviews and preventing duplicate records. Online data quality is ensured through bot and fraud detection, elimination of “short time” completions and restricting survey access via web searches.

The index used by UF researchers is benchmarked to 1966, meaning a value of 100 represents the same level of confidence as that year. The lowest possible index value is two; the highest is 150.

Details of this month’s survey are available at www.bebr.ufl.edu/florida-consumer-sentiment.