Decreased inflation boosts Floridians’ economic outlook

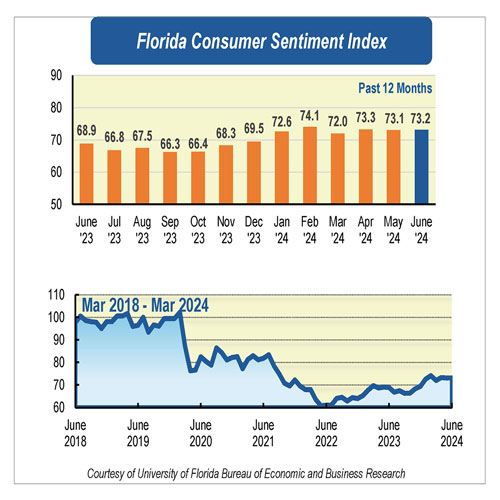

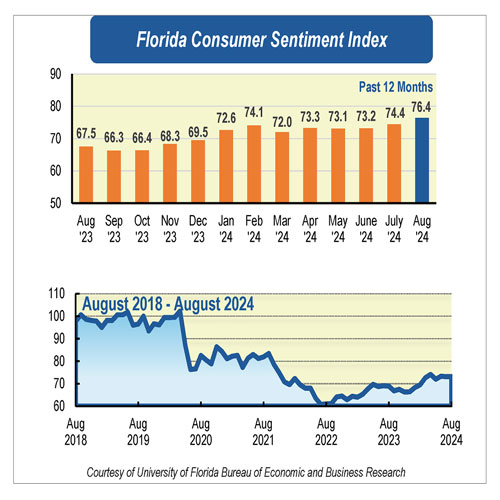

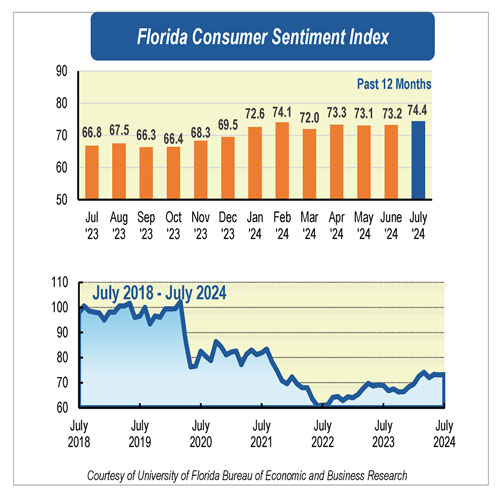

Consumer sentiment among Floridians increased for the second consecutive month in July, rising to 74.4 points, up 1.2 points from a revised figure of 73.2 in June. In contrast, national consumer sentiment declined for the fourth consecutive month, dipping 1.8 points.

Consumer sentiment among Floridians increased for the second consecutive month in July, rising to 74.4 points, up 1.2 points from a revised figure of 73.2 in June. In contrast, national consumer sentiment declined for the fourth consecutive month, dipping 1.8 points.

“It appears that consumer sentiment in Florida has gained traction over the last couple of months. Notably, future economic expectations are at their highest levels since summer 2021, reflecting positive economic prospects among Floridians. Moreover, as inflation recedes, it is likely that the Fed will begin cutting interest rates later this year, which could further enhance economic conditions,” said Hector Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Each of the five components that make up the index increased in July.

Floridians’ opinions about current economic conditions improved in July. Opinions of personal financial situations now compared with a year ago increased 1.8 points from 58.6 to 60.4, the greatest increase of any reading this month. Similarly, opinions on whether now is a good time to buy a major household item, such as a refrigerator or furniture, rose slightly five-tenths of a point from 62.1 to 62.6. These positive views were shared across sociodemographic groups, except for people with an annual income under $50,000, who reported less optimistic views to both components, and people 60 and older, who also reported less favorable views regarding their personal financial situation.

Likewise, expectations about future economic conditions were positive. Expectations of personal finances a year from now increased 1.4 points from 87.4 to 88.8. Notably, these positive expectations were shared by all Floridians except for people with an annual income under $50,000, who expressed less favorable views. Similarly, expectations about U.S. economic conditions over the next year rose 1.6 points from 75.2 to 76.8, while expectations over the next five years increased 1 point from 82.6 to 83.6. However, views regarding the national economy were divided across sociodemographic groups. Women and people with an annual income over $50,000 reported less favorable expectations in both components.

“Floridians’ growing optimism aligns with the current economic outlook. Inflation seems to be receding, with recent data showing a decline in June. The Consumer Price Index (CPI) fell to 3%, while the Personal Consumption Expenditure (PCE) Price Index—the Fed’s preferred measure of inflation—dropped to 2.5%. Economic growth also accelerated in the second quarter, driven by increased consumer spending, with an annual growth rate of 2.8%. Additionally, while there are signs that the labor market is gradually cooling, unemployment remains low by historical standards,” said Sandoval.

“Looking ahead, given the current economic outlook, we expect consumer sentiment to continue improving gradually over the coming months,” Sandoval added.

Conducted June 1 to July 25, the UF study reflects the responses of 229 individuals who were reached on cellphones and 273 individuals reached through an online panel, a total of 502 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/