Floridian sentiment inches higher as national sentiment plummets

Florida Consumer Sentiment Index

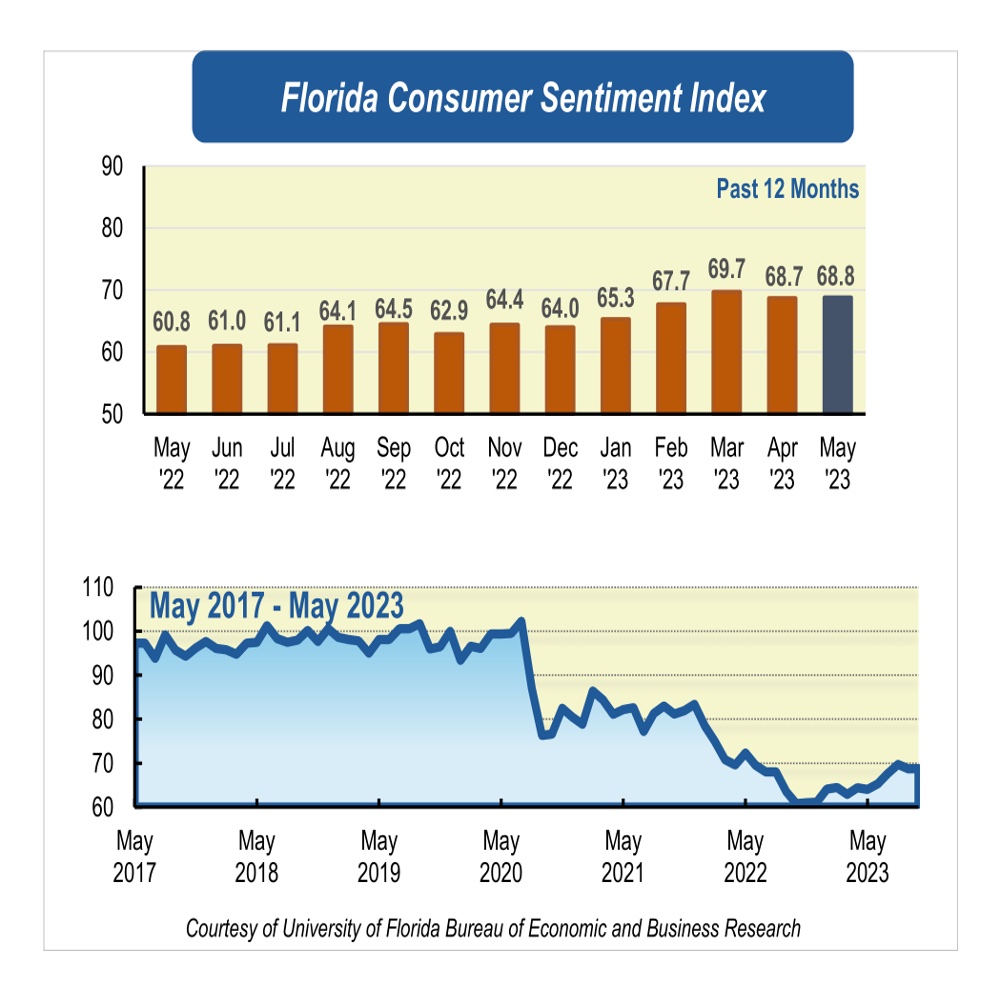

After dropping for the first time in 2023 in April, consumer sentiment among Floridians inched up one-tenth of a point in May to 68.8 from a revised figure of 68.7. On the contrary, national sentiment plunged 4.3 points.

“Despite the ups and downs in consumer sentiment observed over the last 12 months, Florida’s consumer confidence has trended upwards, with a notable increase of 8 points in May compared to a year ago. This positive trend is consistent with a strong labor market and aligns well with the general decline in inflation levels since its peak in June. Nonetheless, it is worth noting that consumer confidence continues to remain at historically low levels,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Among the five components that make up the index, three increased and two decreased.

Floridians’ opinions about current economic conditions portrayed a slightly more optimistic outlook in May. Views of personal financial situations now compared with a year ago increased slightly by nine-tenths of a point from 62.6 to 63.5. Similarly, opinions as to whether now is a good time to buy a big-ticket household item such as a refrigerator or furniture increased 1.7 points from 59.6 to 61.3. However, these views were divided across sociodemographic groups with women and people with an annual income under $50,000 expressing less-favorable views to the former components and people with an annual income above $50,000 to the latter.

The three components corresponding to Floridians’ expectations about future economic conditions were mixed. Expectations of personal finances a year from now decreased slightly three-tenths of a point from 83.6 to 83.3. On the contrary, expectations about U.S. economic conditions over the next year increased slightly three-tenths of a point from 66.3 to 66.6. Finally, the outlook of U.S. economic conditions over the next five years dropped 2.6 points from 71.7 to 69.1. Future outlooks were split across sociodemographic groups with people younger than 60 and people with an annual income above $50,000 expressing consistently more negative views across the three components. Additionally, men expressed more negative views across both components that captured outlooks over the next year.

After the 10th consecutive increase in interest rates since March 2022, when the Federal Reserve initiated the rate-raising cycle to combat inflation, the demand for workers shows no signs of cooling. In fact, Florida's labor market has remained remarkably robust, with strong demand for workers and a consistently low unemployment rate. In April, the state's unemployment rate held steady at 2.6% for the fourth consecutive month, which is lower than the national rate. Moreover, the leisure and hospitality industry showed the largest percent change in job gains over the year, experiencing and increase of 7.3%.

“Despite concerns about persistent inflation, the recent turmoil in the banking sector, and the possibility of further interest rate hikes, we anticipate that consumer confidence among Floridians will continue to trend upward in the months ahead. This is based on the expectation that Florida's tourism industry will experience an increase in demand during the upcoming summer season. It is important to note, however, that this situation may change drastically if the debt-ceiling standoff fails to be resolved and payments on U.S. government debt are not made,” said Sandoval.

Conducted April 1 through May 25, the UF study reflects the responses of 219 individuals who were reached on cellphones and 293 individuals reached through an online panel, a total of 512 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/.