Improved economic outlook propels consumer sentiment higher

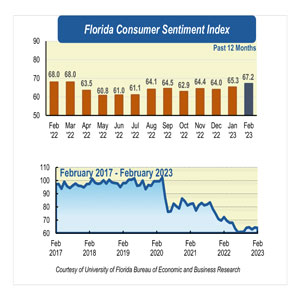

Consumer sentiment among Floridians increased in February 1.9 points to 67.2 from January’s revised figure of 65.3. Similarly, national consumer sentiment increased 2.1 points.

“Consumer sentiment continued to improve for the second consecutive month in February, indicating a reversal in trajectory compared with a year ago. This optimistic outlook is consistent with the observed resilience of the labor market, despite the recent layoffs in the tech sector. Furthermore, the easing of inflation and inflation expectations over past months is also in line with growing optimism," said Hector Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Each of the five components that make up the index increased in February.

Floridians’ opinions about current economic conditions were positive. Views of personal financial situations now compared with a year ago showed the greatest increase in this month’s reading, increasing 3.1 points from 55.4 to 58.5. Similarly, opinions as to whether now is a good time to buy a major household item like an appliance increased 1.7 points from 55.3 to 57, the highest level in the past twelve months. These positive views were shared by all Floridians except for women, who reported less-favorable views to the former component and people with an annual income under $50,000, who reported less-favorable views to the latter.

Outlooks regarding anticipated economic conditions were also positive. Expectations of personal finances a year from now increased 1.5 points from 79.7 to 81.2. Similarly, expectations about the U.S. economic conditions over the next year increased 3 points from 64 to 67, while views of U.S. economic conditions over the next five years increased slightly one-tenth of a point from 72.2 to 72.3. However, positive outlook was not uniform across sociodemographic groups. People with an annual income under $50,000 expressed less-favorable views regarding all three components. Additionally, women and people younger than 60 reported less favorable views regarding their financial situation and national economic conditions over the next 5 years.

“Overall, Floridians are more optimistic in February. The increase in consumer sentiment is attributed to improvements in Floridians' current financial situation compared with a year ago and their expectations for the national economy over the next year. This suggests that consumers' fears of a recession over the next year are declining, which could translate into higher discretionary spending. While a recession is not ruled out from the future economic outlook, improved confidence could assist policymakers in achieving a soft landing, that is, to slow the economy without triggering a recession,” said Sandoval.

“Looking ahead, a tight labor market will likely lead Fed officials to continue raising interest rates and borrowing costs, and to hold these rates higher for a longer period of time to cool the economy and reduce inflation. In turn, this could lead to increased fears of a recession, resulting in a decline in consumer sentiment,” Sandoval added.

Conducted January 1 through February 24, the UF study reflects the responses of 277 individuals who were reached on cellphones and 286 individuals reached through an online panel, a total of 563 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/