Inflation and Hurricane Ian weaken October consumer sentiment

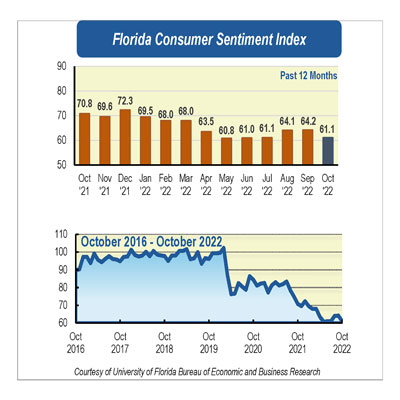

After four consecutive months of modest increments, consumer sentiment among Floridians dropped 3.4 points in October to 61.1 from a revised figure of 64.5 in September.

“The decline in October comes as no surprise as this month’s reading captures the impact of Hurricane Ian, which made landfall September 28 in Southwest Florida and caused business closures, job losses, extensive property damage, and significant human loss,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

“Despite the damaged caused by Hurricane Ian, the storm is unlikely to have a lasting effect on the state's future economic prospects. Furthermore, in terms of consumer confidence, the effects of such disasters tend to be short-lived,” Sandoval added.

Among the five components that make up the index, four declined and one increased.

Floridians’ opinions about current economic conditions were pessimistic. Views of personal financial situations now compared with a year ago decreased 3.5 points from 54 to 50.5. However, these views were divided across sociodemographic groups with men and people with an annual income under $50,000 expressing more-favorable views. Similarly, opinions as to whether now is a good time to buy a major household item like an appliance declined 4.8 points from 53.8 to 49. These opinions were shared by all Floridians but were particularly stronger among women and people with an annual income over $50,000.

“Notably, Floridians’ opinions about whether now is a good time to purchase a big-ticket item reached their second-lowest level in record since the series began tracking consumer confidence in 1985. The drop is not surprising since elevated inflation continues to drive up the cost of living and consumers are cutting back on unnecessary purchases. However, the decline in this component signals a pullback in discretionary spending indicating troubles for retailers during the holiday shopping season,” Sandoval said.

The three components corresponding to Floridians’ expectations about future economic conditions were mixed in October. Expectations of personal finances a year from now decreased slightly one-tenth of a point from 77.4 to 77.3. However, opinions were split with men, people younger than 60, and people with annual income under $50,000 reporting positive expectation. Expectations about U.S. economic conditions over the next year showed the greatest decline in this month’s reading, plummeting 9.3 points from 67 to 57.7. Notably, all Floridians shared this pessimistic view. However, the outlook of U.S. economic conditions over the next five years increased six-tenths of a point from 70.2 to 70.8. Again, opinions were split with men, people age 60 and older, and people with annual income under $50,000 reporting positive views.

“Inflation remains elevated, leading the Fed to continue raising interest rates, increasing the likelihood of a recession. As consumers are likely to react pessimistically, looking ahead, we expect consumer sentiment to remain depressed,” Sandoval said.

Conducted September 1 through October 27, the UF study reflects the responses of 319 individuals who were reached on cellphones and 251 individuals reached through an online panel, a total of 570 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/