Florida’s November consumer sentiment defies national figures, rises despite inflation

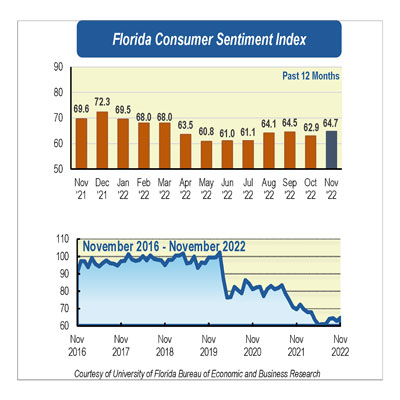

Consumer sentiment among Floridians increased in November to 64.7, up 1.8 points from a revised figure of 62.9 in October. However, national sentiment decreased over three points.

All five components that make up the index increased.

Floridians’ opinions about current economic conditions improved in November. Perceptions of personal financial situations now compared with a year ago increased 1.9 points from 51.9 to 53.8. Opinions as to whether now is a good time to buy a major household item like an appliance increased by 3.7 points from 50.1 to 53.8, the greatest increase of any reading this month. Importantly, these positive views were shared by all Floridians across sociodemographic groups except for men and people younger than 60 who reported less-favorable views to the former component.

Outlooks about expected economic conditions were also positive. Expectations of personal finances a year from now increased slightly one-tenth of a point from 79.7 to 79.8; however, men, people younger than 60, and people with an annual income above $50,000 reported more pessimistic views. Expectations about U.S. economic conditions over the next year increased 2.5 points from 60.2 to 62.7. Notably, this view was shared by all Floridians across sociodemographic groups but were stronger among people with an annual income under $50,000. Finally, views of U.S. economic conditions over the next five years increased nine-tenths of a point from 72.8 to 73.7, though people younger than 60 and those with an annual income above $50,000 reported slightly less-favorable views.

“Consumer confidence dropped following Hurricane Ian, which struck Southwest Florida in late September and caused significant damage. Six weeks later, Hurricane Nicole made landfall on Florida's east coast, but its economic impacts were much less severe. Its effects on consumer confidence were not noticeable in this month’s reading,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

In other economic news, despite October’s uptick in Florida's unemployment rate from 2.5% to 2.7% due to Hurricane Ian's economic impacts, the labor market in Florida remains strong. The labor force participation rate in the state reached 59.6, which is equal to the recent peak observed prior to the pandemic. Moreover, while weekly claims of jobless benefits increased due to Hurricane Ian, they have now declined to the low levels seen prior to the storm.

“A strong labor market should contribute to improved economic prospects and increased consumer confidence and spending. However, Floridians' budgets continue to be burdened by the persistently high inflation, which has depressed their economic prospects and kept consumer confidence at historically low levels,” Sandoval said.

“Inflation has been elevated for more than a year and a half, affecting spending patterns among Floridians and influencing their economic expectations. It comes as no surprise that consumer confidence has remained low over the same period,” Sandoval added.

“Even though inflation may have peaked in June, it is unlikely that it will decelerate rapidly anytime soon. Therefore, it is also unlikely that consumer confidence will improve in the near future,” Sandoval said.

Conducted October 1 through November 24, the UF study reflects the responses of 417 individuals who were reached on cellphones and 302 individuals reached through an online panel, a total of 719 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/