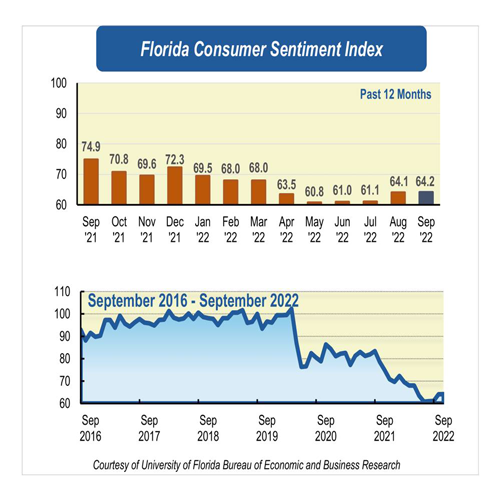

Consumer sentiment remains at Great Recession levels in September

Consumer sentiment among Floridians inched up one-tenth of a point in September to 64.2 from a revised figure of 64.1 in August. Similarly, national sentiment went up by less than a point.

Among the five components that make up the index, two increased and three decreased.

Floridians’ opinions about current economic conditions were gloomy. Views of personal financial situations now compared with a year ago decreased slightly by four-tenths of a point from 53.8 to 53.4. However, these views were divided across sociodemographic groups with men and people with an annual income over $50,000 expressing more favorable views. Similarly, opinions as to whether now is a good time to buy a major household item like an appliance declined by one-tenth of a point from 54.1 to 54. These opinions were also split by demographics with men, people age 60 and older, and people with an annual income over $50,000 expressing more favorable views.

The three components corresponding to Floridians’ expectations about future economic conditions were mixed in September. Expectations of personal finances a year from now increased three-tenths of a point. Similarly, expectations about U.S. economic conditions over the next year went up 1.7 points from 65.2 to 66.9. However, the outlook of U.S. economic conditions over the next five years decreased eight-tenths of a point from 70.4 to 69.6. Future outlooks were split by demographics with women and people with an annual income under $50,000 reporting negative expectations to all three components. People age 60 and older expressed pessimism to the last component as well.

“Floridians are slightly more optimistic in September. Despite this positive change, confidence remains low at levels that are comparable to those observed during the Great Recession,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Hurricane Ian made landfall on September 28 and battered Florida, causing business interruption, job loss, and substantial damage to residential and commercial properties. However, its effect on the state’s economy remains unclear. “While the total economic impacts associated with Hurricane Ian are unknown so far, it creates an additional pressure to the state’s economy” Sandoval said.

“Looking ahead, we expect consumer sentiment to decline in the coming months as the economy slows down due to interest rate hikes and the decline in economic activity brought by Hurricane Ian,” Sandoval added.

Conducted August 1 through September 29, the UF study reflects the responses of 174 individuals who were reached on cellphones and 283 individuals reached through an online panel, a total of 457 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/