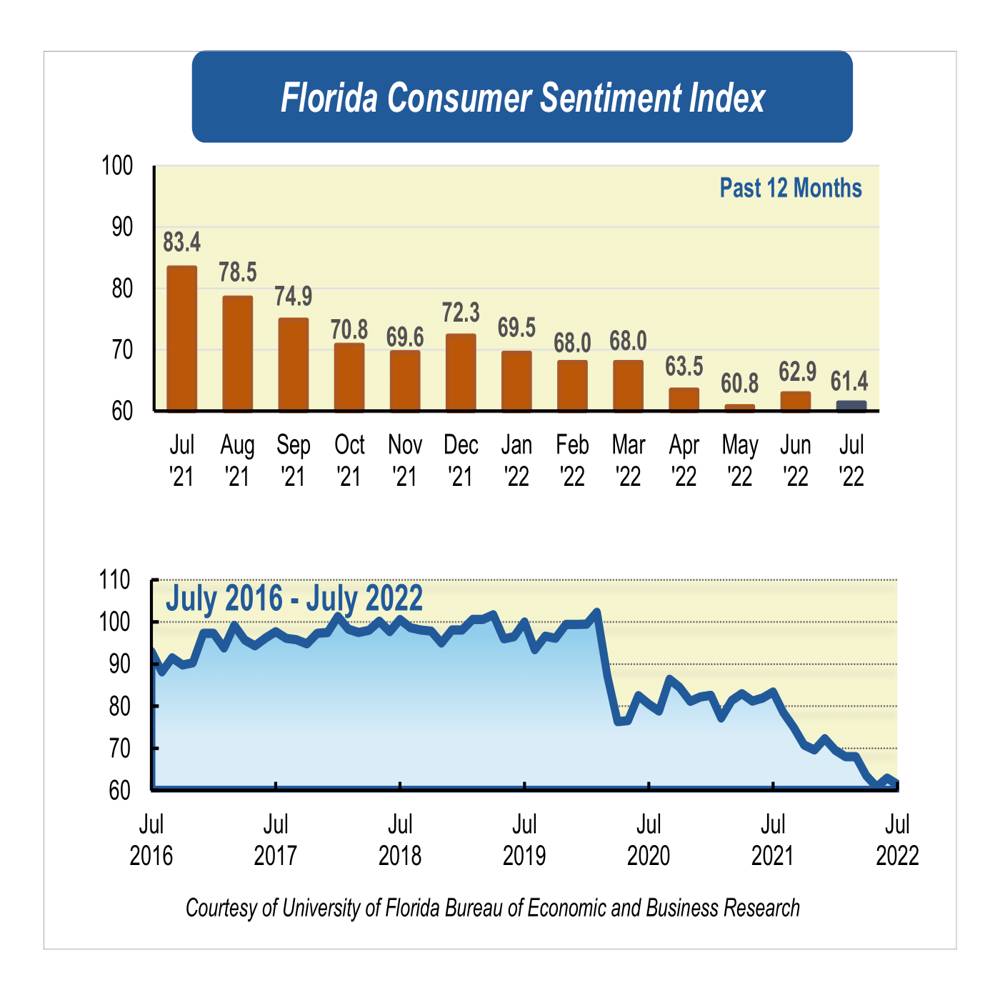

July consumer sentiment continues to rise despite high inflation

Consumer confidence among Floridians increased in July four-tenths of a point to 61.4 from June’s revised figure of 61. Similarly, consumer sentiment at the national level increased in July.

Among the five components that make up the index, two increased, two remained unchanged, and one decreased.

Floridians’ opinions about current economic conditions were mixed. Views of personal financial situations now compared with a year ago decreased slightly five-tenths of a point from 53.8 to 53.3. However, these views were divided across sociodemographic groups with people younger than 60 and people with an annual income under $50,000 expressing more-favorable views.

On the contrary, opinions as to whether now is a good time to buy a major household

item like an appliance increased 1.5 points from 51.1 to 52.6. These opinions were largely shared by all Floridians with the exception of people with an annual income under $50,000, who reported pessimistic viewpoints.

The three components corresponding to Floridians’ expectations about future economic conditions remained mostly unchanged in July. Expectations of personal finances a year from now stayed at 76.1. Similarly, expectations about U.S. economic conditions over the next year held unchanged at 57.8. On the contrary, the outlook of U.S. economic conditions over the next five years increased 1.1 points from 66.3 to 67.4. Future outlooks were split by demographics with no discernible patterns except for those with an annual income under $50,000, who consistently expressed less-favorable views across the three components.

“Floridians are slightly more optimistic in July, but despite this positive change, confidence remains low at levels that are comparable to those observed during the Great Recession,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

“It is noteworthy that Floridians with an annual income under $50,000 reported more pessimistic views in four of the five components that make up the index. This is not surprising, considering the rising cost of housing, groceries, and gasoline, which account for a large portion of their budgets. Inflation increased 9.1% from last year in June, the fastest pace since the early 1980s, indicating that soaring prices will remain as one of the major threats to the economy in the coming months,” Sandoval added.

Job gains have remained strong. According to the Florida Department of Economic Opportunity, Florida’s unemployment rate declined two-tenths of a percentage point to 2.8% in June. Moreover, the state gained 453,600 non-agricultural jobs over the year with all ten major industries experiencing positive gains. Similarly, the U.S. labor market has remained strong.

“However, the strong labor market coupled with elevated inflation will keep the Fed on track to approve further increases in interest rates, raising borrowing costs that are likely to dampen spending, and therefore increasing the risk of a recession. Looking forward, we expect consumer confidence to remain depressed in the months ahead,” said Sandoval.

Conducted June 1 through July 28, the UF study reflects the responses of 200 individuals who were reached on cellphones and 295 individuals reached through an online panel, a total of 495 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/