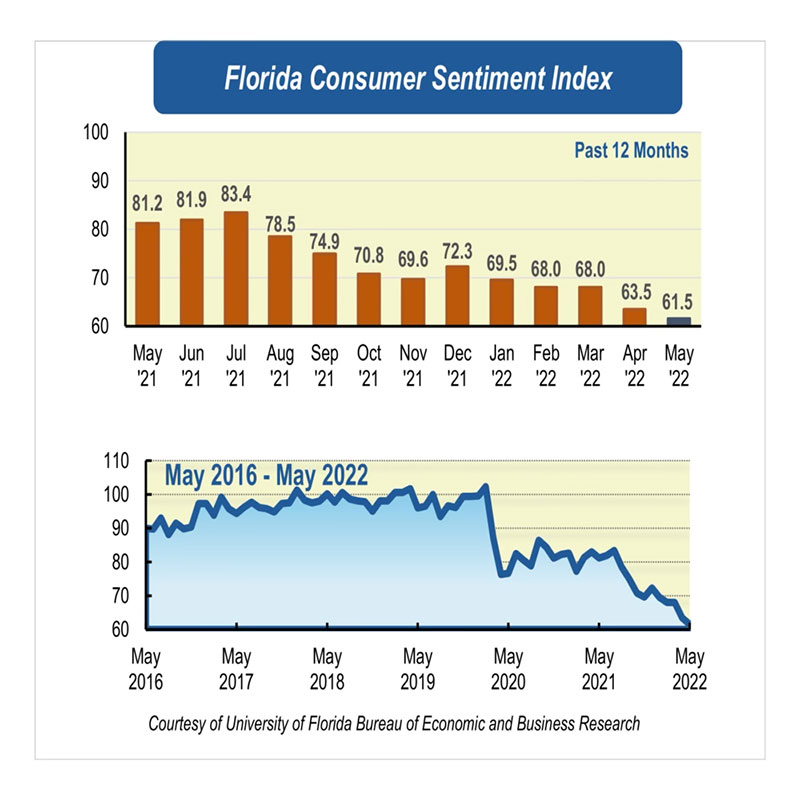

May consumer sentiment falls to near Great Recession levels

Consumer sentiment in Florida deteriorated for a second month in a row in May to 61.5, down 2 points from a revised figure of 63.5 in April. May’s reading is the fourth lowest level on record and is only 2.7 points above the record low of 58.8 from June 2008.

“Consumer sentiment among Floridians has not improved since the beginning of the year. In fact, consumer sentiment has been on a downward trajectory since July 2021, one month after the annual rate of inflation first indicated signs of soaring prices across the board with annual rates exceeding 5%” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Among the five components that make up the index, one increased and four decreased.

Floridians’ opinions about their personal finances now compared with a year ago dropped 3.9 points from 58.8 to 54.9, the largest decline in this month’s reading. Similarly, opinions as to whether this is a good time to buy a major household item like an appliance decreased 1.1 points from 51.7 to 50.6. These pessimistic views were shared by all Floridians across sociodemographic groups except for women and people with an annual income over $50,000, who reported more favorable views to the latter component.

Floridians’ expectations about future economic conditions were mixed. On one hand, expectations of personal finances a year from now increased slightly four-tenths of a point from 74.4 to 74.8. These optimistic views were shared by all Floridians except for people younger than 60, who reported pessimistic expectations. On the other hand, outlooks about national economic conditions deteriorated in May. Expectations about the U.S. economic conditions over the next year dropped 3.1 points from 63 to 59.9. Similarly, outlooks of U.S. economic conditions over the next five years decreased 1.9 points from 69.4 to 67.5. Notably, all Floridians shared these pessimistic outlooks.

“While Floridians expressed more optimism regarding their future personal financial situation, their views concerning the outlook of U.S. economic conditions reflect uncertainty as the Fed attempts to deliver a soft landing while combating the highest inflation in 40 years. Although widely anticipated, as the Fed's rise in interest rates ripples through the economy, it will make it more expensive to purchase a car or a home or carry a credit card balance. Additionally, higher interest rates also raise the possibility of increased unemployment, reduced economic activity, and a recession,” Sandoval said.

“Looking ahead, we expect consumer sentiment to remain weak in the coming months as the effects of higher interest rates are yet to be felt throughout the economy, and as global challenges including rising food and energy prices, the war in Ukraine, and COVID-induced lockdowns in China remain a concern,” Sandoval added.

Conducted April 1 through May 26, the UF study reflects the responses of 284 individuals who were reached on cellphones and 285 individuals reached through an online panel, a total of 569 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/

Hector Sandoval, 352-392-2908, ext. 219, hsandoval@ufl.edu.