Consumer sentiment increases despite record inflation in June

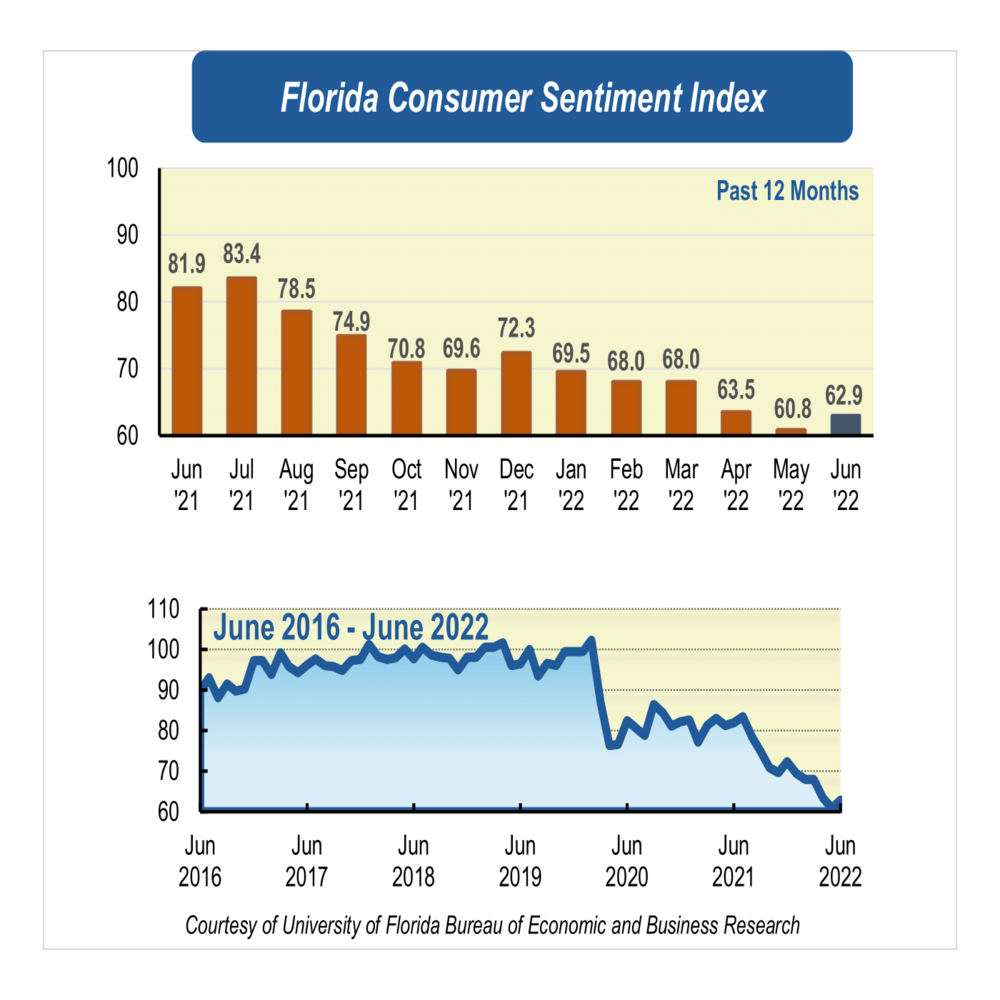

Consumer sentiment among Floridians ticked up for the first time in 2022, up 2.1 points in June to 62.9 from a revised figure of 60.8 in May. In contrast, national consumer sentiment sank to its lowest level on record.

“The increase in June’s consumer confidence in Florida comes as a surprise considering the persistently high inflation. In almost every consumer category, prices are rising, but energy prices are particularly high, squeezing consumers at the pump. Statewide, gasoline prices have reached record levels in recent weeks,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

“Even though Floridians were more optimistic in June, it is worth noting that May’s reading was revised down to 60.8, making it the second lowest ever recorded,” Sandoval added.

Among the five components that make up the index, four increased and one decreased.

Floridians’ opinions about current economic conditions were mixed. Views of personal financial situations now compared with a year ago decreased slightly by one-tenth of a point from 54.8 to 54.7. However, these views were divided across sociodemographic groups; women, people younger than 60, and people with an annual income above $50,000 expressed more-favorable views. On the contrary, opinions as to whether now is a good time to purchase a major household item like an appliance increased 3.2 points from 50.2 to 53.4. Notably, these views were shared by Floridians across all sociodemographic groups.

The three components corresponding to Floridians’ expectations about future economic conditions were more optimistic in June. Expectations of personal finances a year from now showed the greatest increase in this month’s reading, up 3.9 points from 74.1 to 78. Expectations about U.S. economic conditions over the next year rose 1.9 points from 58.6 to 60.5 while the outlook of U.S. economic conditions over the next five years increased 1.2 points from 66.4 to 67.6. These positive views were shared by all Floridians except for people 60 and older, whose reading showed a negative change across the three components and men who reported less-favorable views regarding national economic conditions over the next year.

“Overall, Floridians are more optimistic in June. The increase in consumer confidence is fueled by improvements in Floridians’ expectations about their personal financial situation one year from now and their opinions about whether now is a good time to buy a big-ticket item. These views contrast with the current economic outlook. As inflation is running at a four-decade high, the Fed has approved the largest interest rate increase since 1994 and has indicated that it expects to raise it further this year, increasing the risk of recession,” Sandoval said.

“Even though the labor market has remained strong, higher interest rates will increase the cost of borrowing and slow business growth, which will weaken the job market. Looking ahead, the outlook for consumer sentiment in the near future is pessimistic,” Sandoval said.

Conducted May 1 through June 23, the UF study reflects the responses of 231 individuals who were reached on cellphones and 281 individuals reached through an online panel, a total of 512 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/florida-consumer-sentiment/

Writer: Perry Leibovitz, perry86@ufl.edu

Contact: Hector Sandoval, 352-392-2908, ext. 219, hsandoval@ufl.edu