Economic recovery continues in July

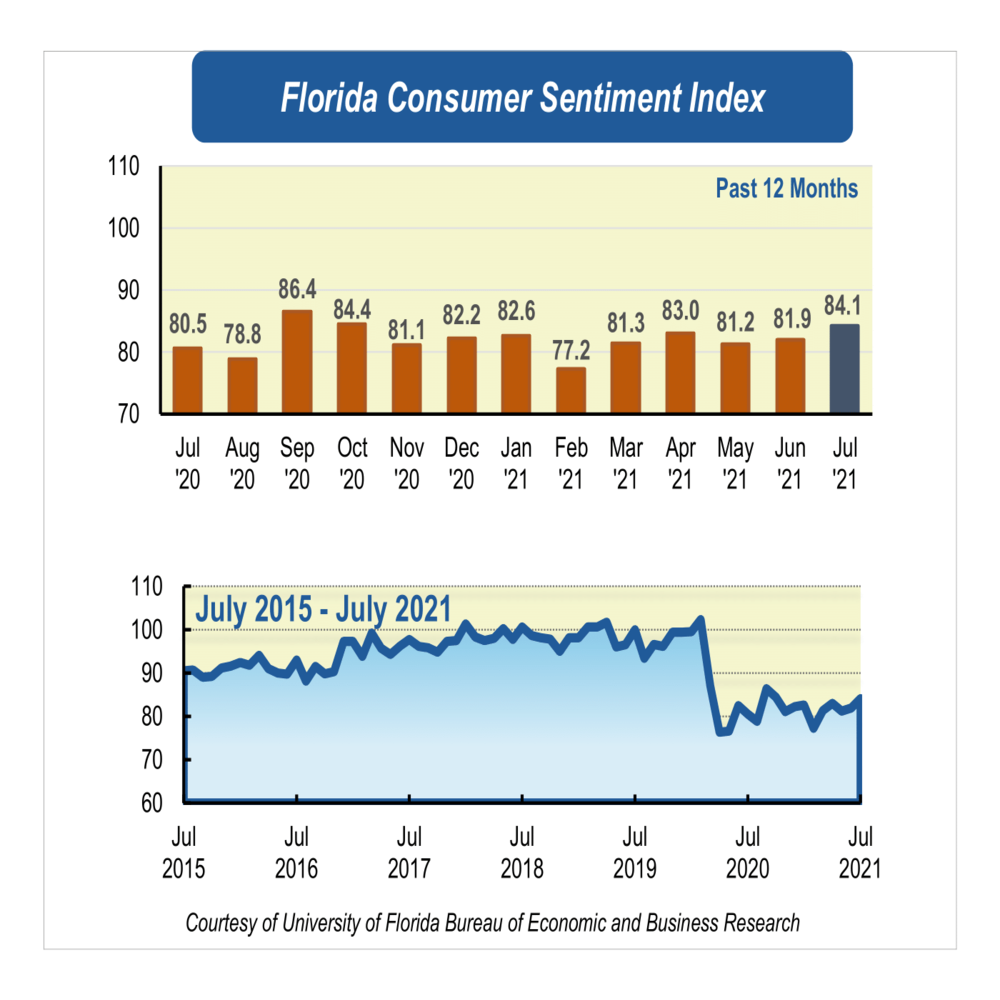

Consumer confidence among Floridians increased in July 2.2 points to 84.1 from June’s revised figure of 81.9.

“Consumer sentiment in Florida increased for the second consecutive month and reached its highest level in 2021. Notably, the U.S. economy exceeded its pre-pandemic peak in the second quarter of 2021. While data is not yet available, a similar result is anticipated for Florida’s economy. The recent trends in consumer confidence indicate increased consumer spending boosting Florida’s economy,” said Hector Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Among the five components that make up the index, four increased and one decreased.

Floridians’ opinions about current economic conditions were mixed. Views of personal financial situations now compared with a year ago increased slightly five-tenths of a point from 76.3 to 76.8. However, these views were divided across sociodemographic groups. Women, people younger than 60, and people with an annual income above $50,000 expressed less-favorable views. On the contrary, opinions as to whether now is a good time to buy a major household item like an appliance decreased two-tenths of a point from 75.8 to 75.6. Similarly, opinions were split by demographics, but in this case, men, people older than 60, and people with an annual income above $50,000 reported less-favorable views.

The three components corresponding to Floridians’ expectations about future economic conditions were more optimistic in July. Expectations of personal finances a year from now showed the greatest increase in this month’s reading, up 3.9 points from 90.9 to 94.8. These positive views were shared by all Floridians with the exception of people with an annual income under $50,000, whose reading showed a negative change. Expectations about U.S. economic conditions over the next year rose 3.2 points from 82.6 to 85.8 while the outlook of U.S. economic conditions over the next five years increased 3.3 points from 84.1 to 87.4. Future outlooks were also split by demographics, with people with an annual income under $50,000 reporting less-favorable views in the former component, and women and people 60 and older expressing less-favorable views in the latter.

“Overall, Floridians are more optimistic in July. The increase in consumer confidence is fueled by improvements in Floridians’ expectations about the outlook of U.S. economic conditions in the short- and long-run. Such expectations anticipate further continued spending and improved economic prospects for Florida,” said Sandoval.

The latest Florida jobs report showed that the unemployment rate inched up again in June to 5%, up 0.1% from May. Moreover, new claims for unemployment benefits increased in July. The average weekly claims over the last four weeks was 8,312, while the average in the previous four weeks was 7,758. Although jobless claims are lower than earlier in the pandemic, the recent trends suggest that the labor market recovery is far from complete.

“Looking ahead, there is no evidence that economic conditions will deteriorate in the short-run. Thus, we anticipate consumer sentiment to keep the pace and increase slowly over the second half of the year,” Sandoval said.

Conducted June 1 through July 29, the UF study reflects the responses of 222 individuals who were reached on cellphones and 306 individuals reached through an online panel, a total of 528 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/sites/default/files/csi/csi_2021_3_august.pdf.