June consumer sentiment bounces back indicating continued recovery

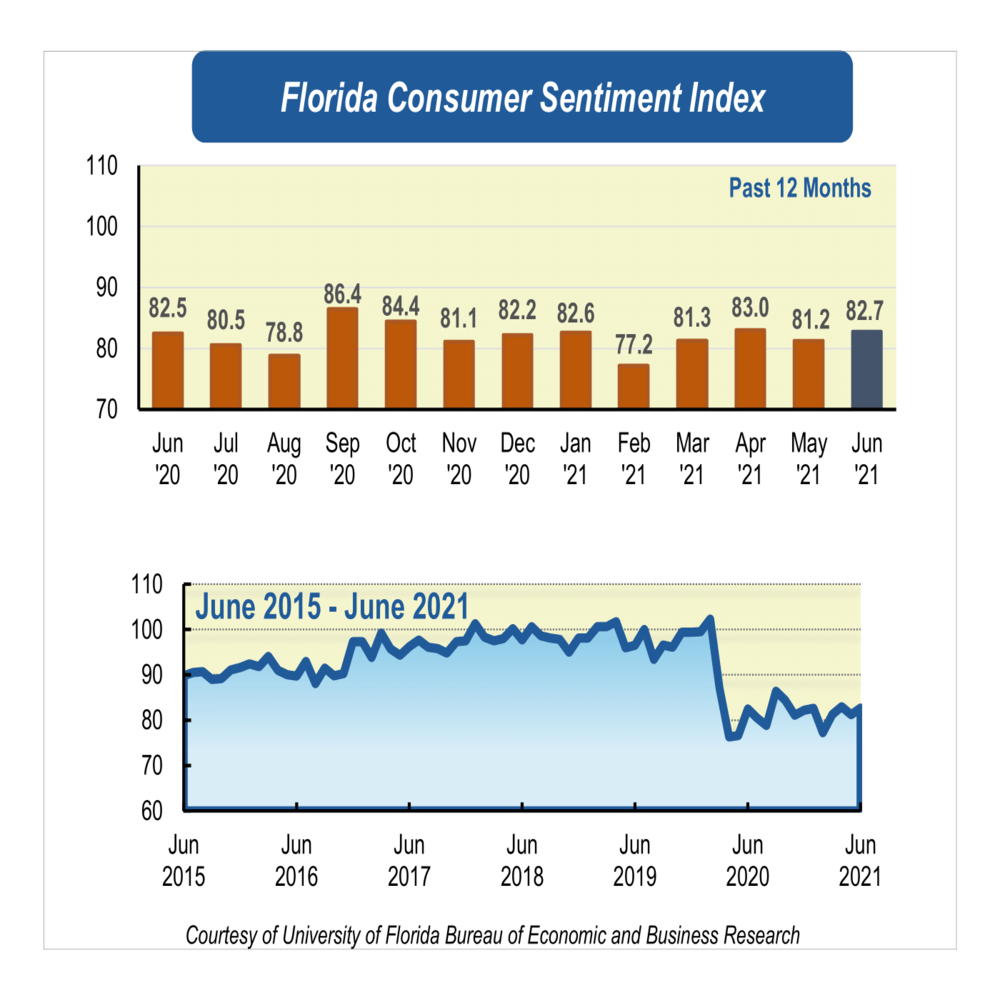

After falling in May, consumer sentiment among Floridians rose 1.5 points in June to 82.7 from a revised figure of 81.2 in May.

The five components that make up the index increased.

Floridians’ opinions about current economic conditions were positive. Opinions of personal financial situations now compared with a year ago increased 3.2 points from 73.5 to 76.7, the greatest increase of any reading this month. This opinion is shared by all Floridians across sociodemographic groups but is stronger among people with an annual income under $50,000. Likewise, attitudes as to whether now is a good time to buy a big-ticket item such as a refrigerator, car, or furniture increased slightly by eight-tenths of a point from 76.7 to 77.5. However, opinions varied by demographics with women, people older than 60, and people with an annual income above $50,000 expressing less-favorable views.

Outlooks about future economic conditions were also positive. Expectations of personal finances a year from now increased 1.3 points from 90.3 to 91.6. These expectations were split by demographics with people older than 60 and people with an annual income above $50,000 reporting less-favorable views. Similarly, anticipations of U.S. economic conditions over the next year increased by eight-tenths of a point from 82.5 to 83.3 and expectations of U.S. economic conditions over the next five years increased 1.1 points from 83.1 to 84.2. However, outlooks about national economic conditions were also split by demographics with people younger than 60 and people with an annual income above $50,000 expressing less-favorable views across both components.

“While the latest jobs report noted that the unemployment rate in Florida went up by 0.1% in May, reaching 4.9%, new filings for unemployment benefits have followed a downward trend in May and reached a pandemic-low in early June. The latter trend suggests that Florida’s labor market will continue to recover in the months ahead,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

“Furthermore, by the end of June, Florida will stop providing $300 a week in federal unemployment assistance to jobless Floridians on top of the maximum provided by the state. The reason behind this move is to push people back into the workforce. However, critics say these benefits have a small impact on job search and workers availability. It remains to be seen whether this move will have a significant effect on the labor market,” Sandoval added.

“Overall, Floridians are more optimistic in June. Nonetheless, consumer confidence has remained mostly unchanged over the past months. Looking ahead, we expect consumer sentiment to keep recovering slowly in the months ahead,” Sandoval said.

Conducted May 1 through June 24, the UF study reflects the responses of 246 individuals who were reached on cellphones and 279 individuals reached through an online panel, a total of 525 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/sites/default/files/csi/csi_2021_29_june.pdf