Positive COVID-19 vaccine news does not stem consumer sentiment decline in November

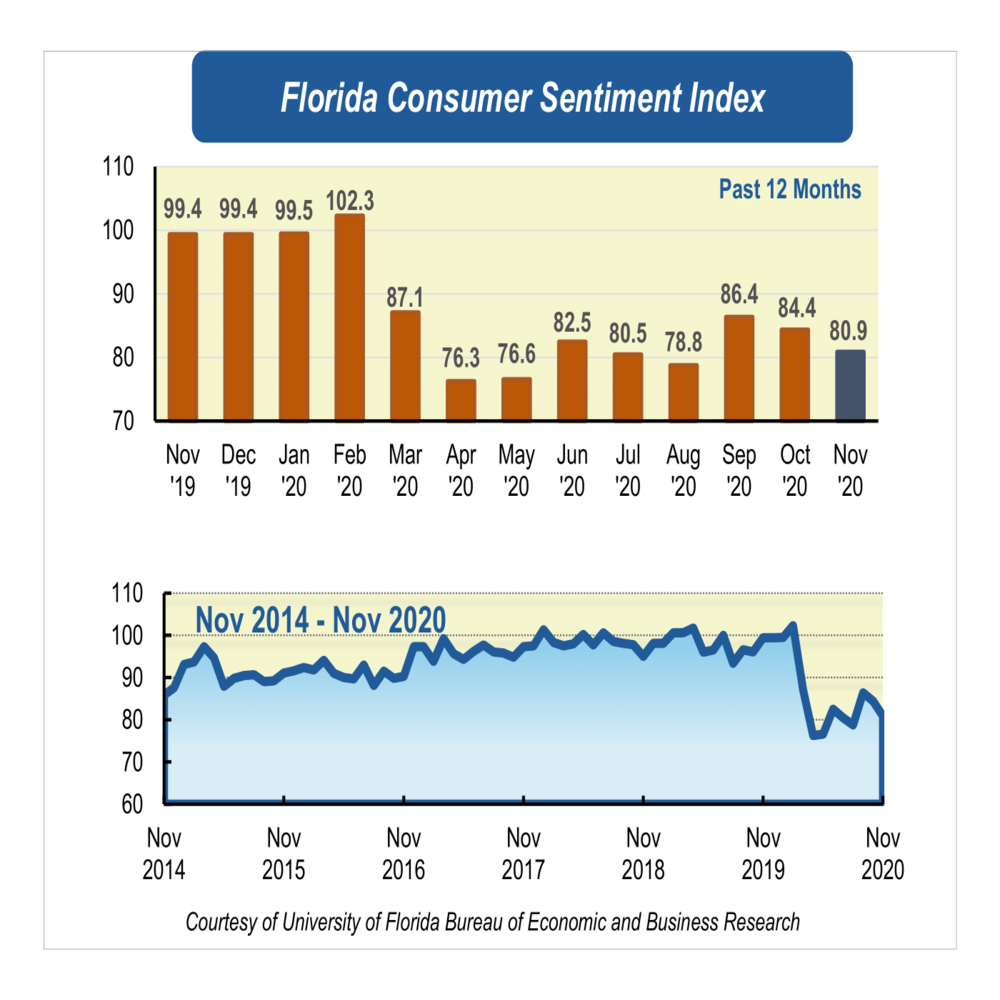

Consumer sentiment among Floridians dipped for the second consecutive month in November to 80.9, dropping 3.5 points from a revised figure of 84.4 in October. Similarly, the University of Michigan’s nationwide index of consumer sentiment decreased 4.9 points.

Among the five components that make up the index, one increased and four decreased.

Floridians’ opinions about current economic conditions were mixed. On one hand, perceptions of personal financial situations now compared with a year ago increased 1.9 points from 67 to 68.9. On the other, opinions as to whether now is a good time to buy a big-ticket item such as a refrigerator or furniture dropped slightly by seven-tenths of a point from 77.5 to 76.8. Although these two components moved in opposite directions, opinions were consistently split across socio-demographic groups. Women and people with an annual income above $50,000 reported less-favorable views while men and those with income under $50,000 reported more-favorable opinions.

The three components corresponding to Floridians’ expectations about future economic conditions deteriorated considerably in November. Expectations of personal finances a year from now plummeted 7.2 points from 98.1 to 90.9. Similarly, expectations about the U.S. economic conditions over the next year dropped 4.2 points from 87.1 to 82.9, while the outlook of U.S. economic conditions over the next five years dropped 7.2 points from 92 to 84.8. These downward readings were shared by all Floridians with the exception of people with an annual income under $50,000 whose expectations about their personal finances a year from now and about the national economic conditions in the short-run showed a favorable change.

“While responses to the different components of the index were split by socio-demographic groups, women and those with an annual income over $50,000 consistently reported less favorable views across all five questions of the index,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

“Despite the positive news about the efficacy of several coronavirus vaccine frontrunners, bringing hope that economic activity can bounce back next year, Floridians’ views about future economic conditions plunged in November,” Sandoval said.

“In fact, most of the pessimism comes specifically from Floridians’ opinions about their personal financial situation now compared with a year from now and from opinions about the national economic outlook in the long-run, signaling that Floridians expect a slow recovery. An important reason behind the decline is the outcome of the presidential election,” Sandoval said.

Contrary to consumer confidence, Florida’s number of weekly claims of unemployment benefits has been trending down in the last weeks, reaching a new pandemic low in November. Similarly, the unemployment rate dropped seven-tenths of a percentage point from 7.2% in September to 6.5% in October. “Although both indicators remain above pre-pandemic levels, the job market in Florida has continued to recover,” Sandoval added.

“Looking ahead, as the cases of coronavirus increase and restrictions are reimposed across the country, limiting social and economic activity, we can expect continued low levels of consumer confidence in the following months,” said Sandoval.

Conducted November 1-25, the UF study reflects the responses of 217 individuals who were reached on cellphones and 255 individuals reached through an online panel, a total of 472 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/sites/default/files/csi/csi_2020_1_december.pdf.