Consumer sentiment falls in October, dragging into the holiday season

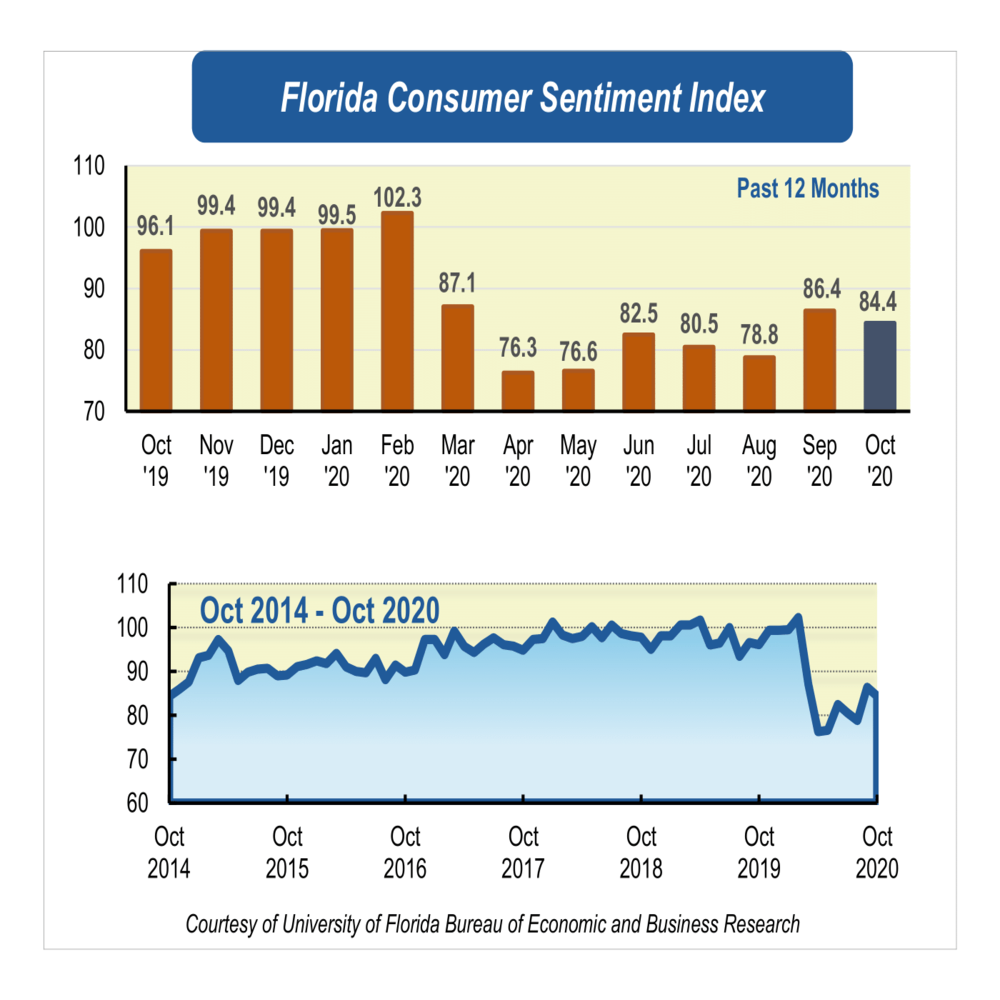

After the largest one-month gain in consumer confidence since the pandemic started in September, consumer sentiment among Floridians dropped 2 points in October to 84.4 from a revised September figure of 86.4.

Among the five components that make up the index, one increased and four decreased.

The two components reflecting Floridians’ views about current economic conditions weakened in October. Views of personal financial situations now compared with a year ago dropped 3.7 points from 71.1 to 67.4. This opinion is shared by all Floridians, but it is particularly stronger among people age 60 and older, women, and those with an annual income under $50,000.

Similarly, opinions as to whether this is a good time to buy a big-ticket household item such as an appliance decreased 2.3 points from 80 to 77.7 and split across age and income levels. While people younger than 60 and people with an annual income over $50,000 reported a small positive change, the declines among people older than 60 and those with an income under $50,000 were particularly strong.

Floridians’ opinions about future economic conditions were mixed in October. Expectations of personal finances a year from now increased 1 point from 97.1 to 98.1, the only uptick in this month’s report. However, again people older than 60 and those with an income under $50,000 expressed less-favorable views.

Expectations about the U.S. economic conditions over the next year dropped 3.7 points from 90.7 to 87, while the outlook of U.S. economic conditions over the next five years decreased 1.6 points from 93.3 to 91.7. These downward trends were largely shared by all Floridians except for women and people with an annual income over $50,000, whose readings were more optimistic regarding long-term national economic conditions.

“While responses to some of the questions of the index were split across sociodemographic groups, people age 60 and older and people with an annual income under $50,000 consistently reported less-favorable views across all five questions. This pattern is consistent with the ‘K-shaped’ recovery that economists are talking about, meaning economic conditions improve for well-educated, higher-skill, and higher-wage workers while hard times continue for the rest,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

“Overall, Floridians are more pessimistic in October than September, and one of the sources of the pessimism is Floridians’ opinions as to whether now is a good time to buy a big-ticket item, a potentially negative sign for retailers during the holiday shopping season. This question of the index reached its lowest level in record in April, when it tumbled 60.5 points with respect to February. It has since bottomed out but has only recovered to about half of the levels recorded before the pandemic started,” Sandoval said.

“Looking ahead, November’s consumer sentiment reading will be very important to gauge Floridians’ opinions and expectations about their economic prospects after the presidential election,” Sandoval said.

Conducted October 1-29, the UF study reflects the responses of 196 individuals who were reached on cellphones and 255 individuals reached through an online panel, a total of 451 individuals, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/sites/default/files/csi/csi_2020_3_november.pdf.