COVID-19 fears shake Florida’s consumer sentiment with steep drop in March

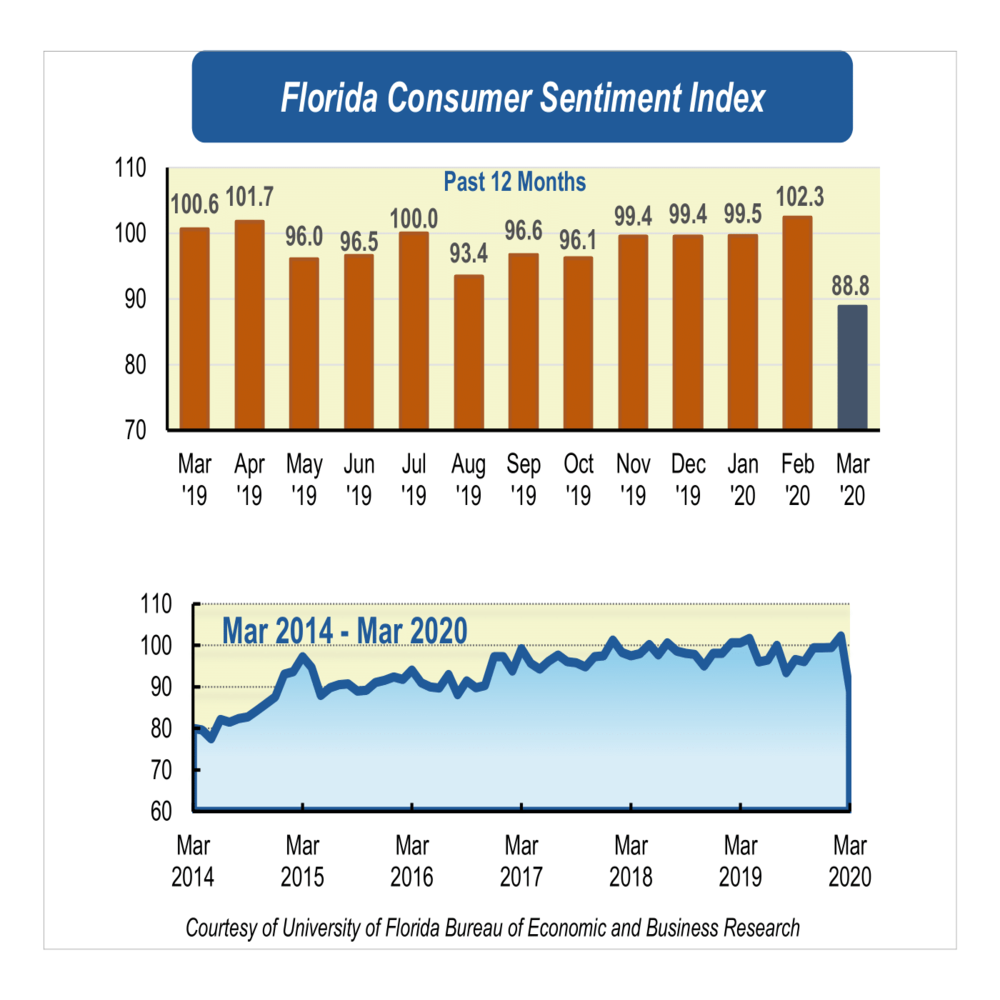

After reaching its highest level in almost 20 years, consumer confidence among Floridians plummeted 13.5 points in March to 88.8 from a revised figure of 102.3 in February. Similarly, consumer sentiment at the national level experienced a decline of 11.9 points.

This is the largest month-to-month decline in record since the series began tracking consumer sentiment in February 1985. The magnitude of the fall is higher than the decline due to Hurricane Katrina in September 2005, which is now the second highest in record with a plunge of 11.7 points.

“The decline in consumer confidence was fueled by growing pessimism in all five components due to the economic damage brought by the coronavirus outbreak,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

All five components that make up the index decreased

Opinions of Floridians about their personal finances now compared with a year ago decreased 8.8 points from 95.3 to 86.5. Opinions as to whether this is a good time to buy a major household item like an appliance dove 29.1 points from 108.6 to 79.5, the steepest decline in this month’s reading. Both downward readings were shared by Floridians across all sociodemographic groups; however, men reported more pessimistic views.

Similarly, the three components representing the expectations of future economic conditions declined among Floridians in March. Expectations of personal finances a year from now fell 4.8 points from 105.4 to 100.6. The outlook of U.S. economic conditions over the next year dropped 20.4 points from 101.9 to 81.5. Additionally, expectations of U.S. economic conditions over the next five years decreased 4.2 points from 100.2 to 96. These downward readings were shared by all Floridians with the exception of those 60 and older, whose expectation about the national economic outlook over the next five years showed a favorable change.

“As consumers stay home and businesses shut down in an effort to contain the spread of the virus, consumer spending has quickly slowed, and massive layoffs have occurred across the state and country. As a result, we observe the largest declines in confidence coming from consumers’ opinions as to whether now is a good time to buy a big-ticket item and their expectations about the national economy in the short-run,” Sandoval said.

In Florida, a total of 74,021 workers applied for unemployment benefits during the week of March 16. The jump from the 6,463 claims filed a week earlier breaks the previous record set in the aftermath of the Great Recession. Across the country, about 3.3 million workers applied for unemployment benefits.

“Looking ahead, we expect consumer confidence to decline as long as the measures to contain the outbreak remain in place. The cumulative economic losses are bringing to an end the economic expansion that started in July 2009. For Florida, a state with a large portion of economic activity in industries severely affected by these measures, the downturn will potentially be more severe,” Sandoval said.

Conducted March 1-26, the UF study reflects the responses of 337 individuals who were reached on cellphones, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at https://www.bebr.ufl.edu/sites/default/files/csi/csi_2020_31_march.pdf.