Consumer sentiment declines for third month in a row, but the economy is strong

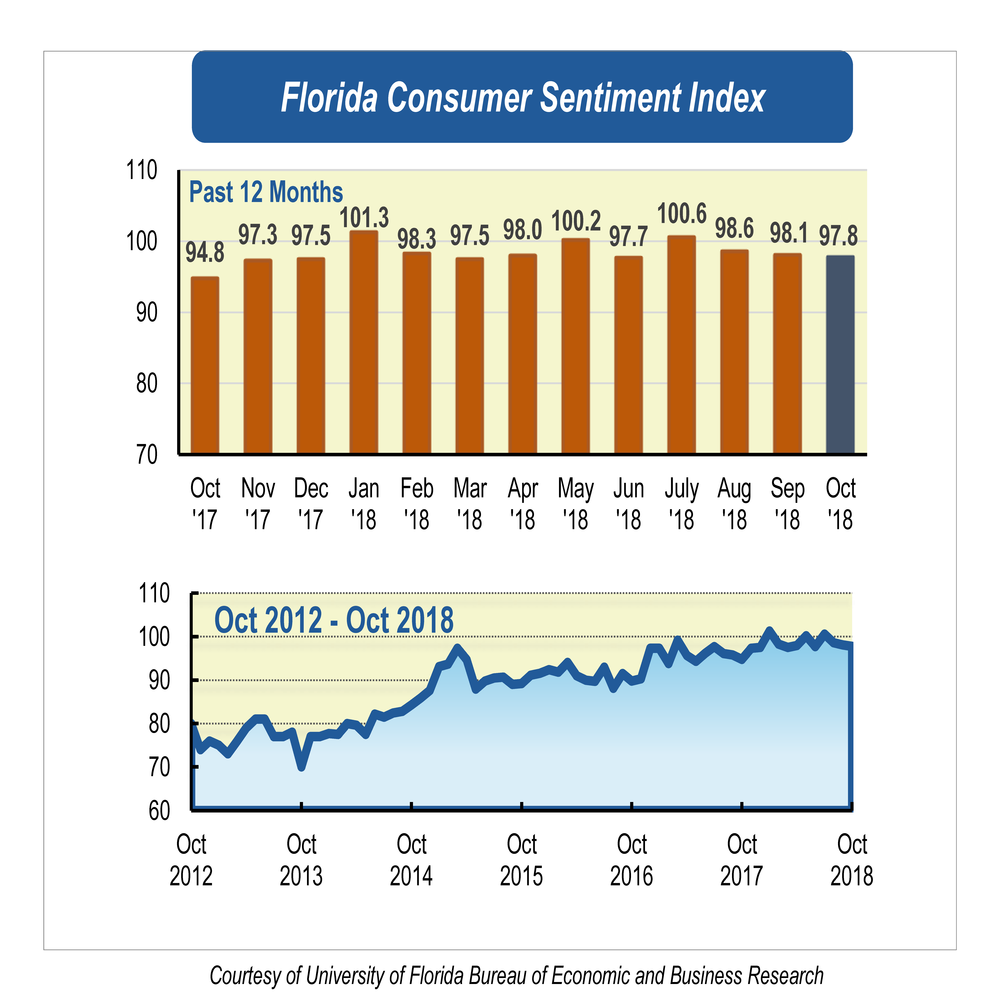

Consumer sentiment among Floridians fell three-tenths of a point to 97.8 from a revised figure of 98.1 in September. Similarly, the University of Michigan’s nationwide index of consumer sentiment decreased in October.

This is the third consecutive month with a decline in consumer sentiment in Florida.

Of the five components that make up the index, three increased and two decreased.

Floridians’ perceptions about current economic conditions were mixed. Perception of one’s personal financial situation now compared with a year ago dropped 3.9 points from 91.8 to 87.9, the greatest decline of any reading this month. The decline is shared by all sociodemographic groups except men and is strongest among women, plummeting 13.7 points.

On the other hand, opinions as to whether this is a good time to buy a major household item such as an appliance showed the highest rise in this month’s readings from 102.5 to 107.4, a change of 4.9 points. That increase is shared by all sociodemographic groups of Floridians with the exceptions of women and those with income levels above $50,000.

“While these two components moved in opposite directions, they showed overall that perceptions regarding current economic conditions increased among Floridians in October,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Anticipation about future economic conditions was also mixed. Expectations of personal finances a year from now increased five-tenths of a point to 102.2 from 101.7. Similarly, expectations of U.S. economic conditions over the next year rose seven-tenths of a point from 100 to 100.7. But expectations of U.S. economic conditions over the next five years decreased 3.4 points from 94.4 to 91.

“Despite the short-run positive expectations held by the population, overall expectations of future economic conditions dropped in October,” Sandoval said.

Florida’s economic conditions remain favorable, with more jobs added this month and further declines in the unemployment rate. According to the latest report, compared with September last year, 407,300 jobs were added statewide, an increase of 4.8 percent. Among all industries, leisure and hospitality gained the most jobs, followed by construction, professional and business services, and education and health services. The unemployment rate decreased two-tenths of a percentage point from 3.7 in August to 3.5 in September.

Hurricane Michael, which made landfall Oct. 10 and battered Florida’s Panhandle, caused business interruption, job loss and substantial damage to residential and commercial properties. However, Its effect on the state’s economy remains unclear.

“While the total economic impacts associated with Hurricane Michael are unknown so far, it is unlikely that they will erase the overall gains in the labor market seen statewide,” Sandoval said.

Hurricane Michael also impacted this month’s data collection. Typically, data are collected through random selection across the state through the entire month. For 10 days during October, data were not collected in the Panhandle. Nevertheless, the number of completed interviews obtained in the northern area of Florida was 24 percent, unchanged from September.

Overall economic conditions in the U.S. also continued to be positive, with a labor market that continued to strengthen and economic activity that has continued to increase. The U.S. unemployment rate declined two-tenths of a percentage point in September. And according to the advance estimate released by the Bureau of Economic Analysis, the real gross domestic product increased at an annual rate of 3.5 percent in the third quarter of 2018.

“Despite the slight decrease in October, consumer sentiment continues to be high in Florida. Floridians’ opinions as to whether now is a good time to buy a major household item increased with October’s reading to its second-highest level of 2018. In addition, unemployment levels in Florida are currently at their lowest since February 2007. All of these indicators are positive signs for retailers who can expect increased spending during the holiday shopping season,” Sandoval said.

Conducted Oct. 1-25, the UF study reflects the responses of 355 individuals who were reached on cellphones, representing a demographic cross section of Florida. The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data.