Consumer sentiment in Florida increases for the second month in a row

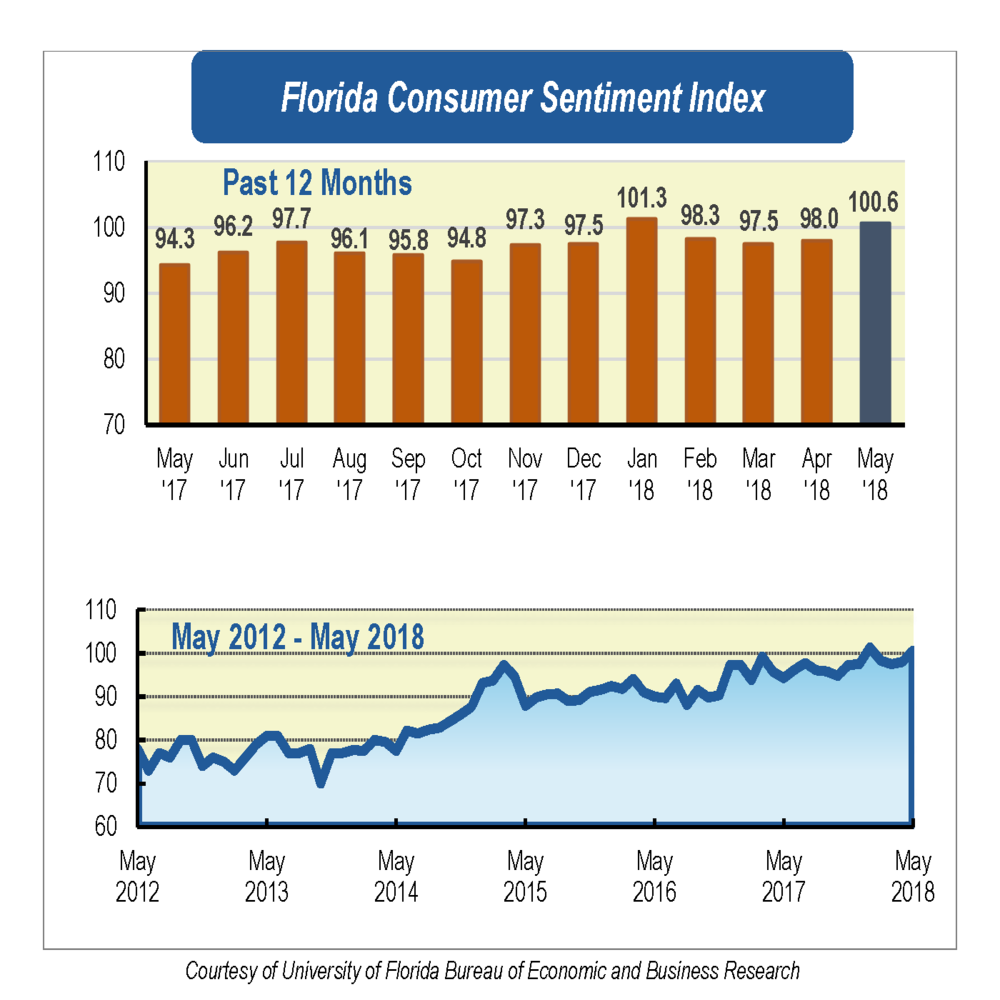

Consumer sentiment among Floridians increased 2.6 points in May to 100.6 from a revised figure of 98 in April.

This marks the second reading over 100 since March 2002, the first being January of this year.

Among the five components that make up the index, three increased and two decreased.

Of the two components that decreased, perceptions of personal financial situations now compared with a year ago showed a greater drop, 2.4 points from 96.1 to 93.7, falling the most among respondents aged 60 and older. In contrast, overall perceptions as to whether this is a good time to buy a major household item like an appliance increased 1.2 points from 104.6 to 105.8. Respondents aged 60 and older were the only demographic to experience a decrease in this indicator.

“Despite the overall increase in confidence and the opposing opinions between these two components, they indicate that opinions regarding the current economic conditions have worsened slightly among Floridians in May,” said Hector H. Sandoval, Director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Expectations of personal financial situations a year from now declined 1.9 points from 107.6 to 105.7 and expectations of U.S. economic conditions over the next year increased substantially by 11.3 points from 91.2 to 102.5, the greatest increase in this month’s reading. The latter is particularly strong compared with a month ago among those aged 60 and older and those with income levels under $50,000. Finally, expectations of U.S. economic conditions over the next five years increased 4.6 points from 90.5 to 95.1. These three components represent the expectations about future economic conditions, which show a general increase among Floridians.

“Overall, Floridians are more optimistic, and the gain in May’s confidence came mainly from consumers’ future expectations about the national economy in the medium- and long-run. Notably, these expectations are shared by all Floridians regardless of their age or socioeconomic status,” Sandoval said.

Economic activity in Florida continues to expand with more jobs added every month. In April, 178,400 more jobs were added statewide compared with a year ago, an increase of 2.1 percent. Among all industries, professional and business services gained the most jobs, followed by construction, leisure and hospitality, and education and health services. The Florida unemployment rate has remained unchanged at 3.9 percent for the past eight months. Furthermore, according to the Bureau of Economic Analysis , real gross domestic product in Florida increased 3.7 percent in the fourth quarter of 2017. The real estate and rental and leasing industry and the construction industry contributed the most to the increase.

“Despite the ups and downs, consumer sentiment has been very favorable over the year and has remained quite stable since the beginning of 2018. Looking forward, we anticipate consumer sentiment to remain high in the months to come,” Sandoval said.

Conducted May 1-24, the UF study reflects the responses of 358 individuals who were reached on cellphones, representing a demographic cross section of Florida.The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data