Florida consumer sentiment turns upward in September

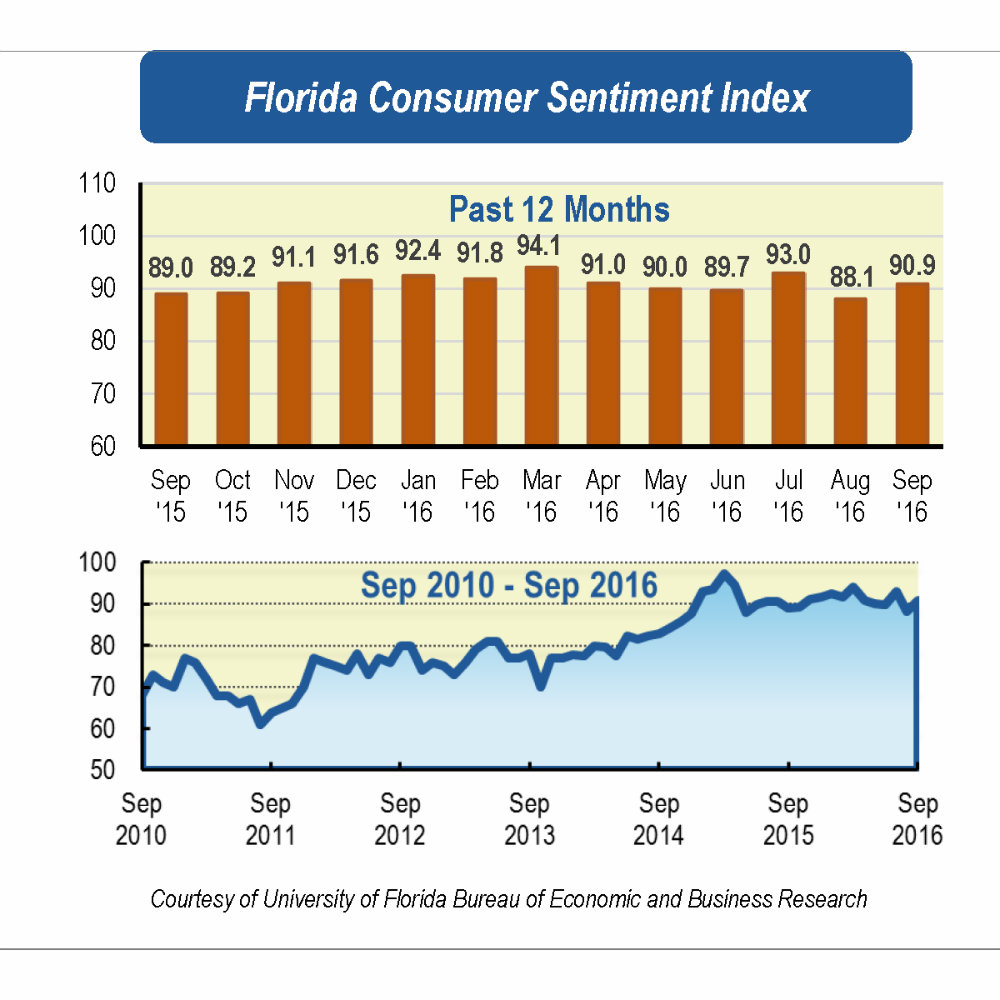

Consumer sentiment among Floridians ticked up 2.8 points in September to 90.9, according to the latest University of Florida consumer survey.

Among the five components that make up the index, four increased and one remained unchanged.

Perceptions of one’s personal financial situation now compared with a year ago climbed 3.2 points from 77.3 to 80.5. Opinions as to whether now is a good time to buy a big-ticket item like an appliance went up 4.2 points to 101.6. These two components together indicate that Floridians’ opinions of current economic conditions improved in September.

“The latter increase is mainly driven by the population aged 60 and over, but in general, Floridians expressed more positive views compared with last month’s index score,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Expectations of personal finances a year from now rose slightly by 1.6 points to 100.1.

Expectations of U.S. economic conditions over the next year remained unchanged at 85.1 points, while anticipated U.S. economic conditions over the next five years showed the greatest increase of any component, up 5.2 points from 82 to 87.2.

“Perceptions of present conditions and expectations about future conditions each explained about half of the change in this month’s consumer sentiment index,” Sandoval said. “Furthermore, the overall positive change is independent of age, gender and income.”

The Florida economy continued adding jobs statewide in August, and Florida unemployment is at the lowest level since the last recession, unchanged at 4.7 percent for the last three months. Many experts think this means Florida has reached its “natural” rate of unemployment, which is the unemployment rate that the economy will tend to gravitate around in the long run, despite fluctuating during shorter-term booms and busts.

While Florida’s economy is growing, with more jobs added every month, questions are being raised about the quality of those jobs.

“Despite these positive trends in the labor market, labor force participation is decreasing, and there is evidence of an underlying change in the employment structure, with more Floridians in lower-paying jobs compared with pre-recession levels,” Sandoval said. “Adding more low-wage and low-skill jobs does not directly translate into a higher standard of living for Florida workers.”

Last week the Federal Reserve Board decided to leave interest rates unchanged. The Fed’s low-interest-rate policy holds savings rates low for those who put money in a bank and encourages investors to seek higher returns in other riskier investments. But it also keeps the cost of borrowing low for firms and households who need credit.

“This month’s spike in perceptions as to whether this is a good time to buy a big-ticket item could be due to the Fed’s announcement,” Sandoval said.

The current election season may also affect the opinions of Florida consumers.

“It’s not unusual to see politics creep into the consumer sentiment index during a presidential election, particularly in the expectations of U.S. economic conditions,” said bureau Director Chris McCarty. “The contrast between the candidates’ approach to the economy is as stark a contrast as any election in recent memory. While the polls show a tight race, this may ultimately bode well for Clinton in Florida.”

Conducted Sept. 1-25, the UF study reflects the responses of 431 individuals who were reached on cellphones, representing a demographic cross-section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data