April drop in Florida consumer sentiment: widespread concern over future

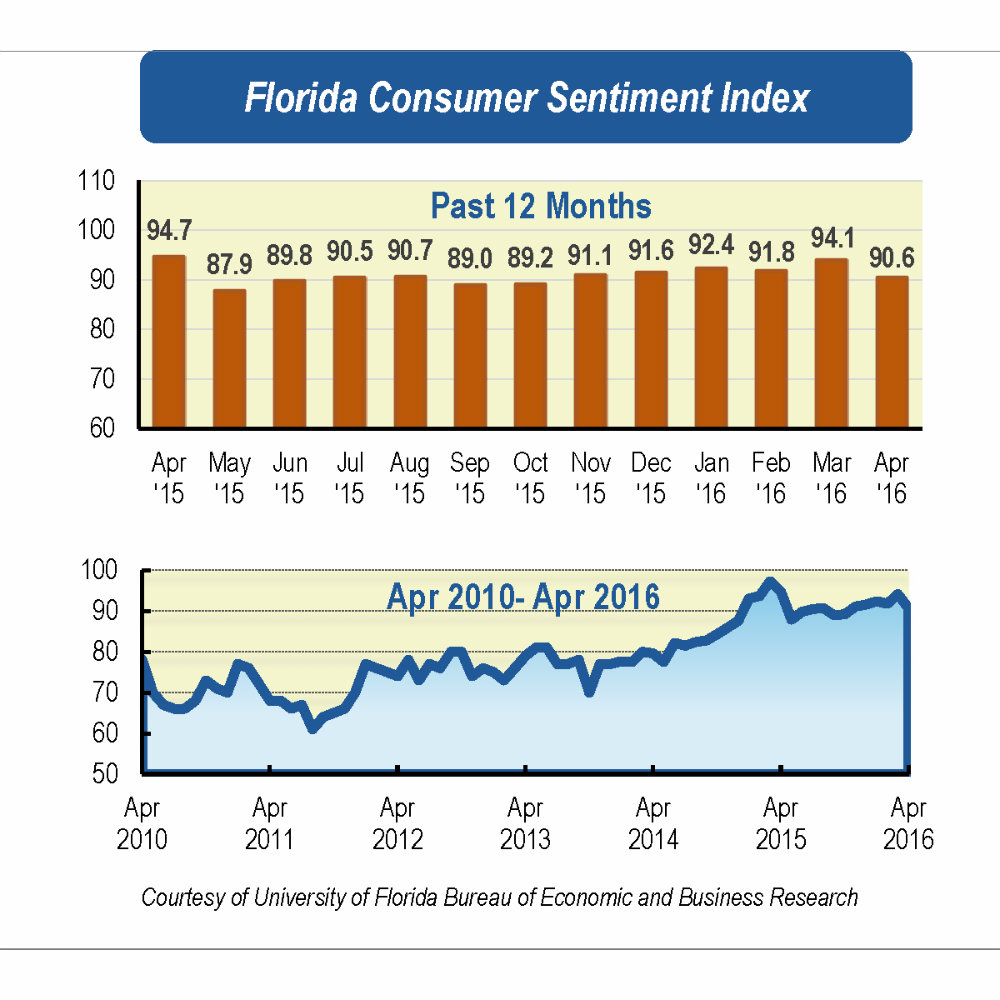

Consumer sentiment fell 3.5 points in April to 90.6, according to the latest University of Florida consumer survey.

The reading is the lowest since October and lower than the previous 12-month average. Of the five components that make up the index, four decreased and only one increased.

Perceptions of one’s personal financial situation now compared with a year ago show the greatest decline in this month’s reading, a 5.8-point change from 84.2 to 78.4.

“The decline in the perception of personal finances explains around one-third of the overall change in the index. The biggest drop was in those 60 and older, but this lower perception is shared in general by all Floridians.” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Perceptions as to whether now is a good time to buy a big-ticket item, such as an automobile or appliance, inched up seven-tenths of a point to 102.1. Expectations of personal finances a year from now went down by 4.2 points to 101.5.

Both short- and long-run outlooks on the U.S. economy showed signs of deterioration. Expectations of U.S. economic conditions over the next year decreased 3.3 points to 86.2, while expectations of U.S. economic conditions over the next five years dropped 5.1 points, from 90 to 84.9.

“Most of the pessimism in April stems from expectations about future conditions, which account for 70 percent of the drop in the consumer sentiment index,” Sandoval said. While unfavorable views of the future were shared by all Floridians independent of their gender, age, and income level, the sharpest declines were seen among those 60 and older and those with income under $50,000.

The gloomy future outlook of those 60 and older may be influenced by the flurry of recent news stories about today’s deadline for Social Security changes enacted by Congress last fall. While few seniors are directly affected by closing the file-and-suspend loophole, many find it unsettling to realize that Congress can make changes to the bedrock of retiree income.

The unemployment rate in Florida declined again in March from 5.0 to 4.9 percent according to the latest employment report. The number of jobs added in March statewide was 234,300 compared to a year ago, but that figure was only up 3,000 compared to the previous month.

“Notably, this is the smallest monthly gain since May 2012,” Sandoval said.

The industry gaining the most jobs was professional and business services, followed by education and health services, and the trade, transportation and utilities industry.

In the week ending April 16, the number of people in the U.S. filing for unemployment insurance fell to its lowest level since November 1973. The latest information for Florida also shows an important reduction in the initial claim of unemployment benefits during April. Furthermore, the four-week moving average, which smooths the weekly variation, displays the same pattern. The weekly claims of unemployment insurance typically reflect what is presently going on in the economy.

“Labor market conditions in Florida continue to be favorable in general, hence the expectation was for a slight increase in consumer sentiment rather than a reversal,” Sandoval said.

Conducted April 1-24, the UF study reflects the responses of 417 individuals who were reached on cellphones, representing a demographic cross-section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data