Florida consumer sentiment ticks up in time for holidays

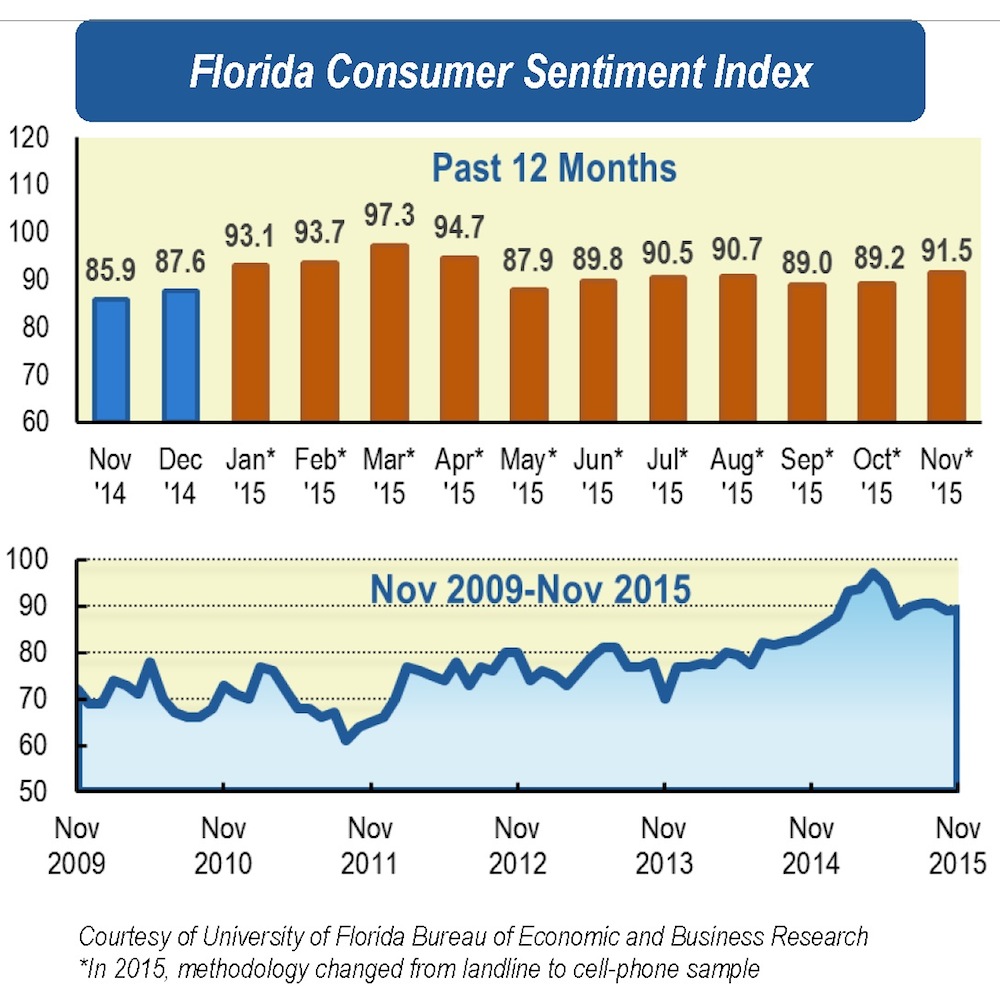

Consumer sentiment among Floridians rose more than two points in November to 91.5, up more than five points compared with November last year, according to the latest University of Florida consumer survey.

Among the five components that make up the index, four increased and one declined.

Perception of personal finance now compared with a year ago showed the greatest increase, surging 6.4 points to 86.2.

While all income groups had improved readings regarding personal finances, the increase was particularly strong among those with incomes under $50,000. That group’s sentiment regarding their personal financial situation now compared with a year ago rose 7.7 points, and its expectations of personal finances in the next year was up 7.8 points.

Expectations of U.S. economic conditions also rose by 2.6 points over the next year and two points for the next five years.

The positive view of national economic conditions, both in the short- and long-run, was more pronounced among men than among women.

“On expected national economic conditions in the upcoming year, the reading went up 8.7 points for men but declined 3.3 points among women,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

The only component to drop overall was whether now is a good time to buy a big-ticket item, such as a car, which was down four-tenths of a point from October. This may be a seasonal effect reflecting consumers who expect price drops closer to the end of the year.

The Florida unemployment rate declined again in October to 5.1 percent, still slightly higher than the national rate of 5 percent. Moreover, 239,900 jobs were added statewide in October, a 3 percent increase compared with last year.

However, the Florida underemployment rate, which takes into account all the workers who are marginally attached or are employed part-time for economic reasons, remains high at 11.9 percent for the third quarter of 2015, significantly higher than the U.S. rate of 10.2 percent.

There are also labor market differences within the state of Florida. At the county level, the unemployment rate ranges from 3.4 percent in Monroe County to 9.4 percent in Hendry County.

“These are signals that the labor market still needs further recovery, but the overall economic climate and consumer sentiment are very favorable,” Sandoval said.

The National Retail Federation has forecasted sales in November and December to increase 3.7 percent, and the Florida Retail Federation expects an increase of 4.5 percent.

“All these positive signals for the holiday sales season will help labor market recovery and may further improve economic perceptions in the following months,” Sandoval said.

Conducted Nov. 1-22, the UF study reflects the responses of 454 individuals who were reached on cellphones, representing a demographic cross section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data

For more information, please contact Hector Sandoval at hsandoval@ufl.edu or 352-392-2908, ext. 219.