UF: Floridians' growing consumer confidence falters just a smidge

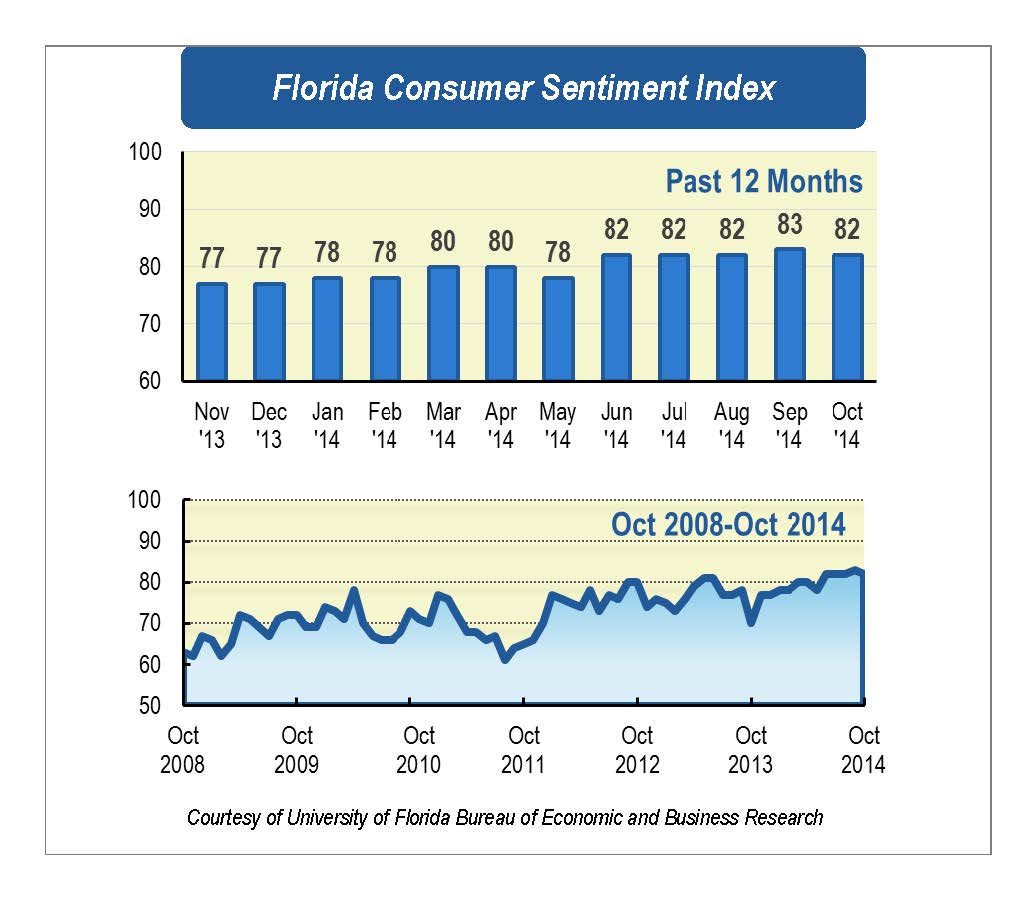

GAINESVILLE, Fla. --- Consumer sentiment among Floridians dropped a point in October to 82, the first decline in the index since May, according to a monthly University of Florida survey.

“This decline is not likely indicative of a trend,” said Chris McCarty, director of UF’s Survey Research Center in the Bureau of Economic and Business Research, which conducts the survey. “Given that the stock market has improved late in the month and the decline was only a point, we don’t view the drop as significant.”

Of the five components used in the survey -- three declined, one increased, and one stayed the same. Survey-takers’ overall perception whether their personal finances are better now than a year ago fell four points to 71, while their expectations of being better off financially one year from now fell one point to 82.

The survey shows that confidence in the national economy over the coming year fell one point to 78, but it rose a point to 82 when respondents were asked to consider U.S. economic conditions over the next five years.

Finally, respondents’ perception as to whether it is a good time to buy big-ticket item, such as a washing machine, stayed the same at 96.

“We note that the decline in the sentiment index was mostly among those in higher income households who are more likely to have holdings in the stock market either directly or indirectly through retirement accounts,” McCarty said. “Responses to the personal finance questions were particularly pessimistic for that group.”

The gloomy outlook for the stock market is fueled by concerns over declining global markets, expected Federal Reserve interest rate hikes and the potential economic effects from Ebola, McCarty said.

Overall, economic indicators for Florida have been steady. Unemployment for September declined to 6.1 percent, .2 percent higher than U.S. unemployment of 5.9 percent.

However, an increase in jobs rather than a decline in the labor force was a major reason for the drop in the unemployment figure, McCarty noted. Other data show a fuller employment picture. The unemployment rate for part-time and discouraged workers is the 12th highest in the country at 13.4 percent. In addition, Florida’s hourly wages and median income are much lower than the national average.

“We tend to generate lower paying jobs than we had before the recession,” McCarty said. “Much of this is due to a decline in construction employment, which peaked at 691,000 jobs in June 2006 and has dropped 40 percent to 414,000 in September.”

Housing in Florida remains strong. The median price of a single-family home in September was unchanged at $180,000, while closed sales were high compared with previous years. “But housing gains may slow in 2015 as the Federal Reserve raises short-term interest rates, which will likely lead to higher mortgage rates,” McCarty said.

Inflation, meanwhile, remains low largely because of declines in gasoline prices. Florida’s sales tax revenue, which has exceeded state economists’ expectations, indicates relatively strong sales in 2014. National retail sales, in contrast, were weak in September, although strong for much of the year.

“There are headwinds that may make it difficult for the index to rise much next month,” McCarty said. “In addition to a struggling global market, we have a gubernatorial election. Most polls show a very close race, and as is typical after such elections, about half of the electorate will not be happy with the outcome. This mood often shows up in the sentiment index for that month, but it will not last and will not affect holiday sales which are expected to be better than last year.”

Conducted Oct. 1-23, the study reflects the responses of 424 individuals, representing a demographic cross-section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2; the highest is 150.

Details of the October survey can be found at http://www.bebr.ufl.edu/cci.

Credits

Writer: John Dunn, dunnj@embarqmail.com

Contact: Chris McCarty,352-359-0974, ufchris@ufl.edu